USD/JPY Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Entries must be made only between 8am London time today to 5pm New York time, and then after 8am Tokyo time tomorrow (Tuesday).

Risk 0.75% of equity.

Long Trade 1

Long entry following bullish price action on shorter time frames following the price falling below 104.67.

Place a stop loss 1 pip below the local swing low.

Take off 75% of the position when the profit is double risk and leave the remainder to ride.

Long Trade 2

Long entry following bullish price action on shorter time frames following the price falling into the zone between 104.00 and 104.20.

Place a stop loss 1 pip below the local swing low.

Take off 75% of the position when the profit is double risk and leave the remainder to ride.

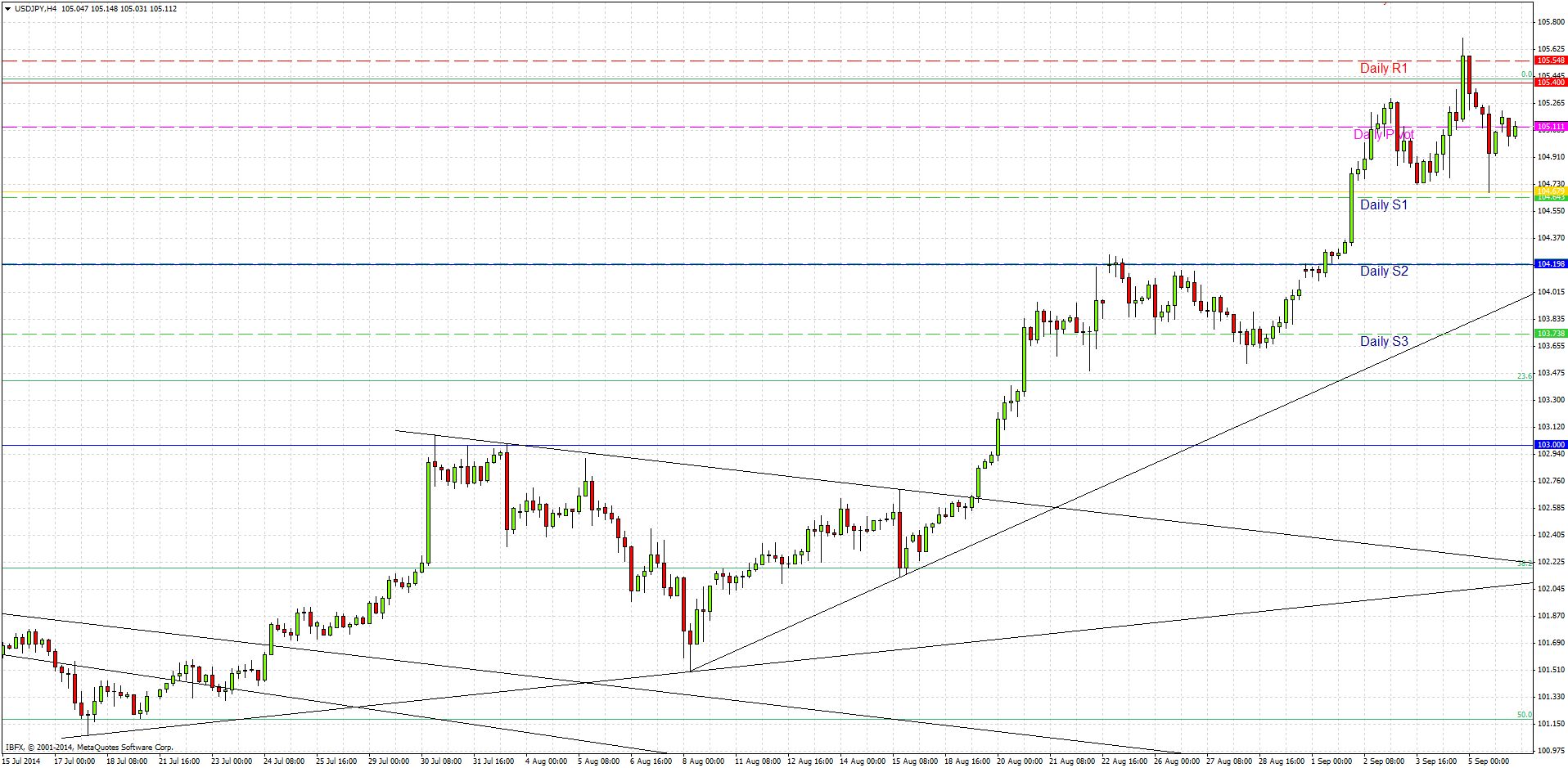

USD/JPY Analysis

Since my previous forecast last Thursday morning, the price did make a new 6-year high before falling off. However the lows seem to be holding so there is no strong reason yet to abandon a bullish bias.

The USD remains strong and the JPY remains weak.

There are likely to be buying opportunities below the key swing low at 104.67. If we keep falling below that, we are quite likely to find some support in the zone around the last two weekly opens in the area above 104.00.

If we fall and remain below 104.00, that would be a very bearish sign.

There are no high-impact data releases scheduled today concerning either the JPY or the USD. It should be a quiet day.