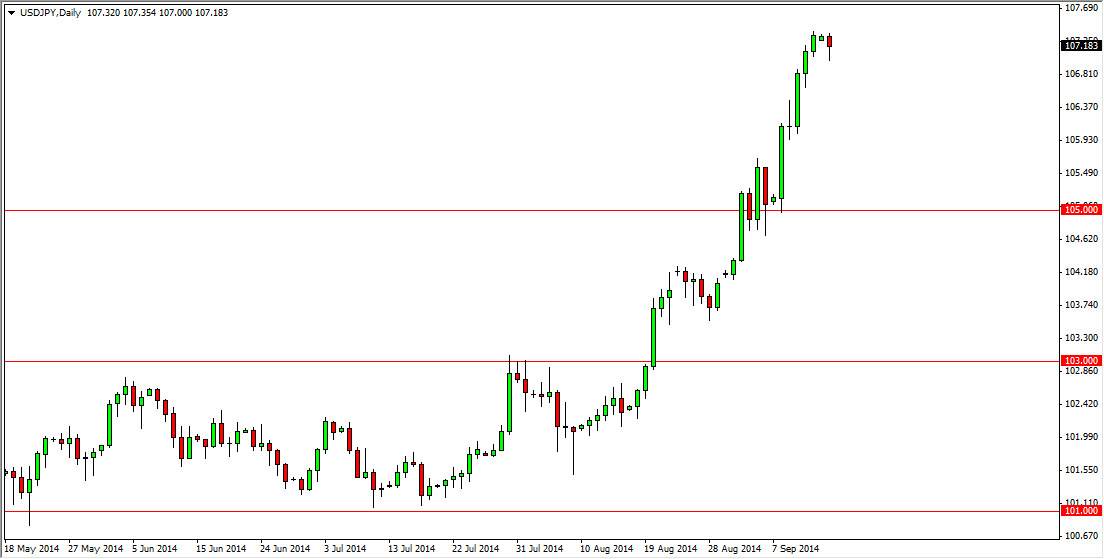

The USD/JPY pair fell during the course of the day on Monday, but as you can see found enough support at the 107 level to turn things back around and form a hammer. The hammer of course is a very bullish sign, and as a result I do believe that there will be continued buying pressure in this marketplace. However, I am a bit hesitant to start buying here even though the candle from the session on Monday was in fact very bullish. I would prefer to see some type of pullback in order to recognize value in the US dollar.

I still believe that the 105 level is the “floor” in this market, and as a result I see an opportunity to buy this market all the way down to there on supportive candles, and I would feel much better using one at a lower level as the market is without a doubt parabolic.

Sometimes we are paid to wait.

Jesse Livermore once stated that we are sometimes paid to wait when it comes to the marketplace. However, we are waiting to see whether or not the market goes back to test the 105 level for support. We would fully anticipated to prove to be, but this would also be classic technical analysis which of course would get me very interested in going long.

I ultimately believe that this market goes to the 110 level, which is the longer-term resistance barrier above. We are currently in an area that is of little importance as far as longer-term trades are concerned, so therefore I don’t necessarily look at this as an opportunity to start buying even with a supportive candle. It is all about taking your time and been very careful about when you place your trades, especially when it comes to a longer-term trade. I think that we will have that opportunity but it should be at lower levels. Essentially you are buying the US dollar “on sale” if this pair does pullback, which of course I do think it will. Patience will be crucial.