The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.7% on Tuesday as better-than-expected Chinese manufacturing data developments in the Middle East combined to provide support to the precious metal. Geopolitical concerns returned to the forefront after the United States and allies launched air and missile strikes on ISIS strongholds in Syria. Pentagon press secretary John Kirby said "I can confirm that U.S. military and partner nation forces are undertaking military action against terrorists in Syria using a mix of fighter, bomber and Tomahawk missiles".

Although escalating conflict in the region increased gold's attractiveness as a safe-haven asset and caused some investors to flee from equities, skepticism about the sustainability of gains continues to weigh on the market. Since February, geopolitical risks only created temporary effects on prices. Because of that, I will be paying more attention to the technical levels.

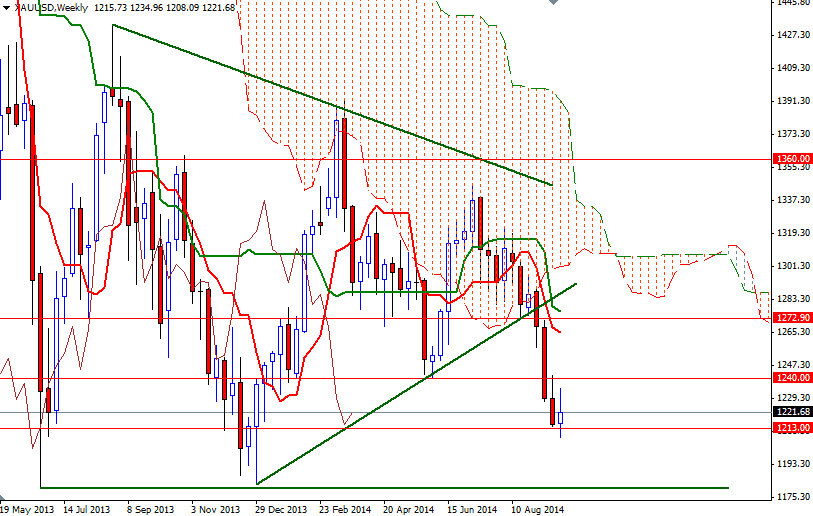

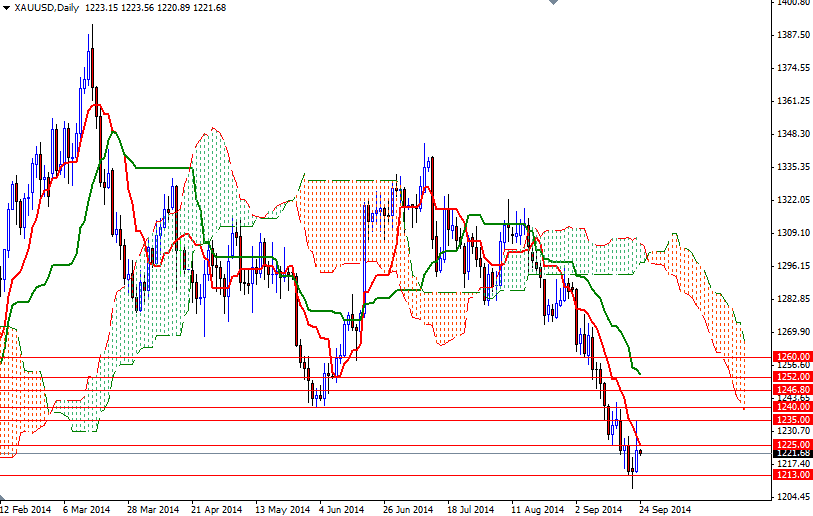

Speaking strictly based on the charts, the location of the Ichimoku clouds on the weekly and daily time frames shows there are strong resistance levels to the upside. However, the bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) cross on the 4-hour chart suggest there is a chance we will see the pair trading higher. If the bulls build some steam and shatter the 1225 - 1229 barrier, the XAU/USD pair will probably have enough momentum to retest the 1235 resistance level. In order to consider the possibility of a stronger rally, closing above the 1240 level is essential. If the bears take the reins and push prices back below 1213, support can be found at 1208 and 1200. Once below 1200, there is little to slow this pair down until we reach the next key support at the 1180 level.