The XAU/USD pair (Gold vs. the American dollar) closed yesterday's session with a loss, erasing most of the gains in the previous session, as the bulls failed to overcome the resistance level at 1225/9. The XAU/USD pair traded as low as $1214 an ounce after a report released from the Commerce Department revealed that sales of new houses climbed 18% percent to an annualized pace of 504K units in August. It appears that upbeat economic data will continue to offset concerns over the Middle East and push money into the dollar and equities.

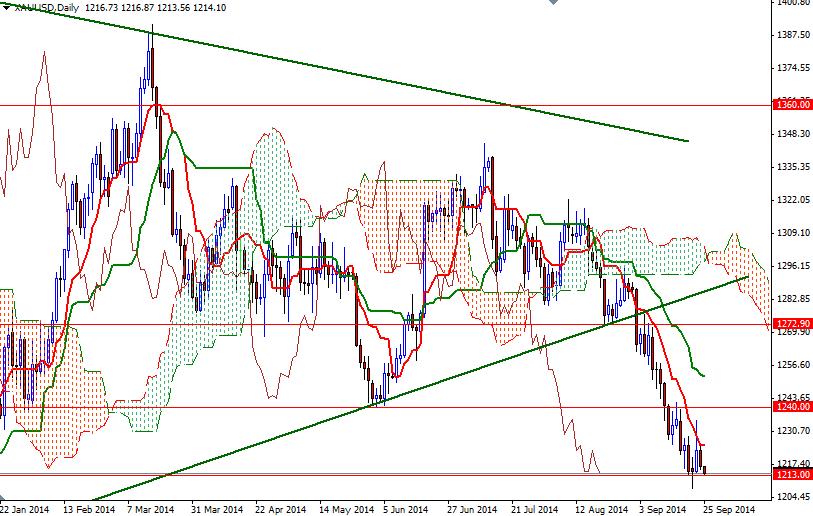

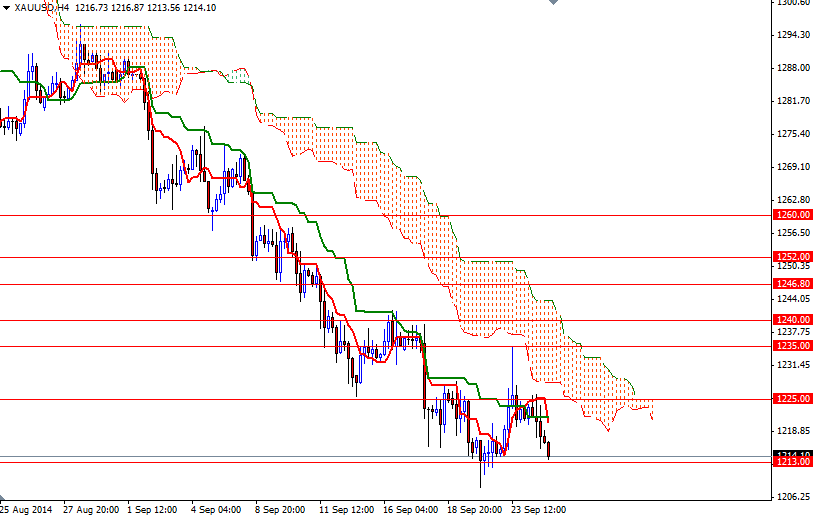

Since the market dropped below the Ichimoku cloud on the daily time frame, I have been repeating that the broader directional bias remains weighted to the downside. Technically speaking, the Ichimoku cloud indicates an area of support or resistance and in our case clouds represent the resistance zones. Of course, thickness of the cloud is important as well because the thicker the cloud, the less likely it is that prices will manage a sustained break through it.

Until the market anchors above the cloud -on the 4-hour time frame at least- there won't be any technical reason to buy gold. I think the bulls will need to push the market above the 1225/9 resistance zone in order to test the next barrier located at 1335/40. Only a daily close above this critical resistance could provide the bulls the momentum they need to march towards the 1252 level where the Kijun-sen (twenty six-day moving average, green line) resides on the daily chart. To the down side, support can be found between the 1213 and 1208 levels. The bears will have to shatter this floor (which the bulls have been trying to defend recently) if they intent to charge towards the 1200 level.