GBP/USD Signals Update

No signal was given yesterday.

Today’s GBP/USD Signals

Risk 0.75% of equity.

Entries must be prior to 5pm London time today.

Short Trade

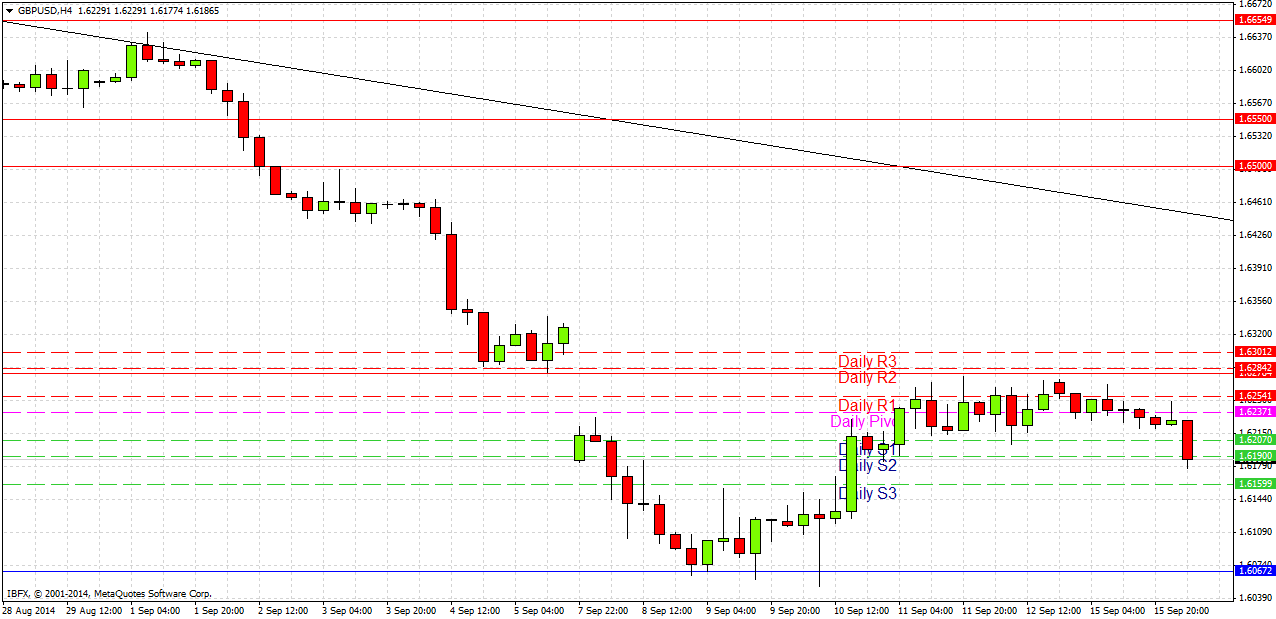

Short entry following a strong lower high after a major high once 1.6278 is rejected.

Put a stop loss 1 pip above the local swing high.

Remove 75% of the position when profit is double risk and leave the remainder to run.

Long Trade

Long entry following a strong higher low after a major low once 1.6067 is rejected.

Put a stop loss 1 pip below the local swing low.

Remove 75% of the position when profit is equal to risk and leave the remainder to run.

GBP/USD Analysis

I wrote yesterday that to a large extent this pair is at the mercy of the result of the Scottish referendum on independence this Thursday, and will fluctuate in accordance with new opinion polls as they are released. However, technically we are seeing a fall off from a swing high now, so at the time of writing it looks like we are moving down towards key support at 1.6067. There is flipped resistance above us at the swing high at around 1.6278. Trades can be taken on bounces off either of these levels, although more weight should be given to shorts unless an opinion poll is released showing a strong swing towards a Scottish no vote.

There are high-impact events scheduled today concerning both the GBP and the USD. At 9:30am London time there will be a release of U.K. CPI data, followed later by US PPI data at 1:30pm. Therefore today should be a more active day for this pair.