GBP/USD Signals Update

Yesterday’s signals were not triggered and expired. The price did reach 1.6500, but there was no bullish action there during the London session.

Today’s GBP/USD Signals

Risk 0.75% of equity.

Entries may be made only from 8am to 5pm London time today.

Short Trade 1

Short entry following bearish price action on the H1 time frame after the first touch of 1.6500.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6450.

Take off 50% of the position as profit at 1.6450, and then leave the rest of the position to run.

Short Trade 2

Short entry following bearish price action on the H1 time frame after the first touch of 1.6550.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6500.

Take off 50% of the position as profit at 1.6500, and then leave the rest of the position to run.

Short Trade 3

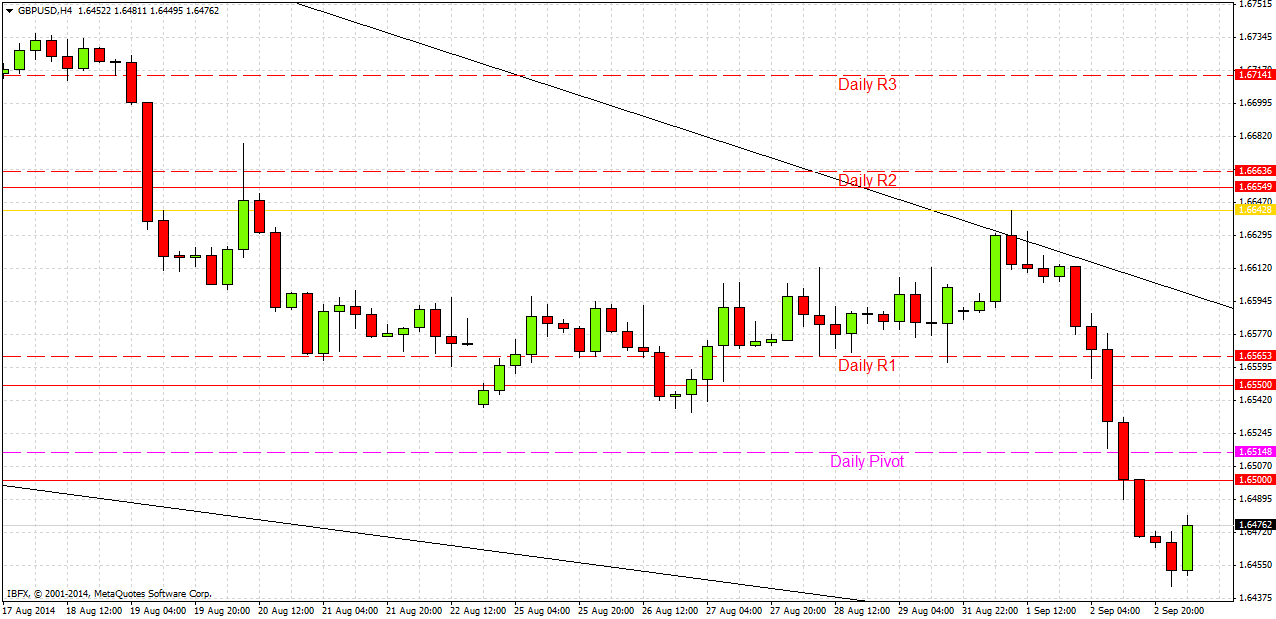

Short entry following bearish price action on the H1 time frame after the first touch of the bearish trend line shown on the chart below.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6550.

Take off 50% of the position as profit at 1.6550, and then leave the rest of the position to run.

GBP/USD Analysis

The price fell strongly yesterday, breaking through two levels that were expected to be supportive. Overall the action was very bearish although the GBP has been showing a little strength this morning.

There are no new obvious resistant levels at which to go short, but we might expect the previously supportive levels at 1.6500 and 1.6550 to provide resistant opportunities, especially if the GBP news due this morning spikes us up there.

Regarding the GBP, at 9:30am London time there will be a release of Services PMI data. There are no high-impact data releases due today for the USD. Therefore the New York session is likely to be the more active part of the day.