The cable pair has recently been sold off rather viciously, but on Friday we got a bit of a reprieve in the value of the Pound. After all, the Non-Farm Payroll report came out lighter than anticipated, and this would have had people thinking that perhaps the US economy wasn’t as strong as originally thought. Also, it could have had some people thinking that it was less likely that the Federal Reserve will tighten anytime soon, and therefore the Dollar took a little bit of a hit for the session.

However, as the day went on, I suspect that a lot of traders would have questioned the result of the NFP report, and because of this they went “against the grain” as stock indices rose by the time the session closed. This limited some of the British Pound gains in my estimation as well, and because of this, my outlook on this pair hasn’t changed at all.

The trend is set, and I don’t see that changing.

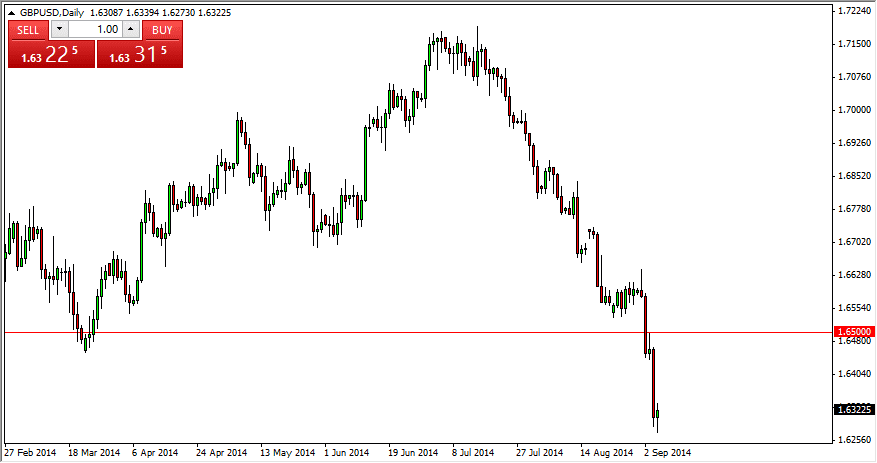

The trend in this market is obviously very strong, and as a result I have no interest whatsoever in buying the Pound. The 1.65 level being broken to the downside was yet another negative sign, and with that I believe that the next target is going to be the 1.60 handle. After all, on the longer-term charts, the area seems to be of extreme interest for the market, and these things tend to repeat themselves over time.

The Pound will continue to take a bit of pressure, as the United Kingdom sees concerns about the economy unfold. After all, there are parts that they can’t control – the European Union is heading into deflation at the moment, and they are the largest trading partner of the United Kingdom. In other words, one of the biggest problems that the British face is the Europeans.

The market isn’t something that I have any interest in going long in until we break well above the 1.66 handle, and only on a daily close. The rallies going forward will continue to be selling opportunities. The market will continue to be bearish.