EUR/USD Signal Update

Yesterday’s Short Trade 1 signal was triggered and gave more profit than risk before turning around for a loss. I did not take this trade as the volatility was extremely low.

Today’s EUR/USD Signals

Risk 0.75% of equity.

Entries may only be made after 1pm London time today.

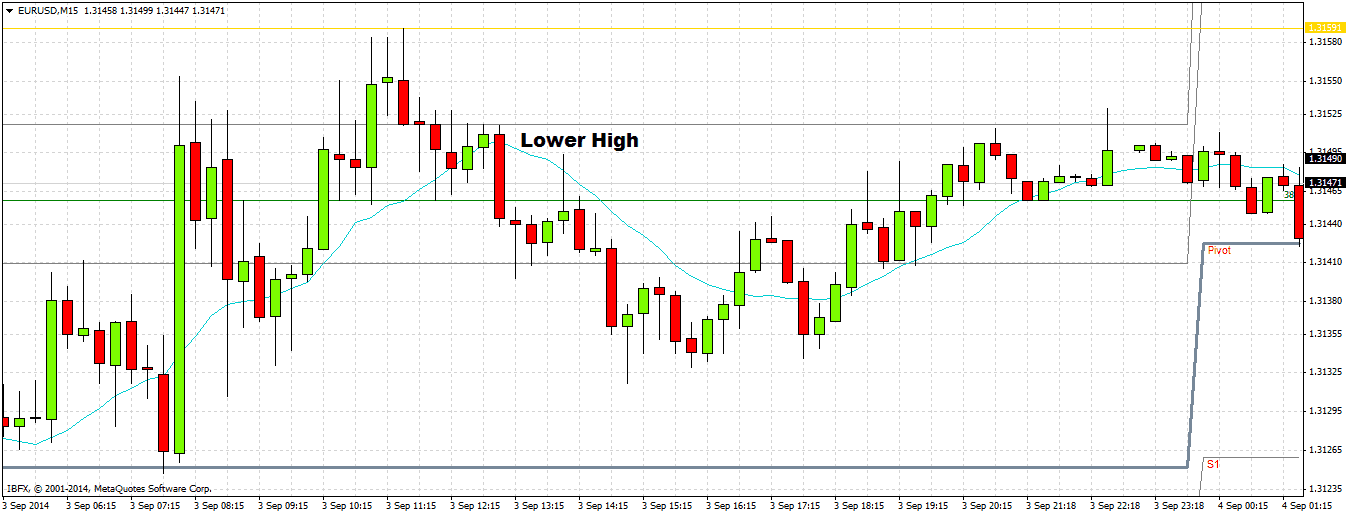

Short Trade 1

Short entry following a strong lower high after a major high once 1.3159 is broken to the up side.

Put a stop loss 1 pip above the local swing high.

Remove 75% of the position when profit is double risk and leave the remainder to ride.

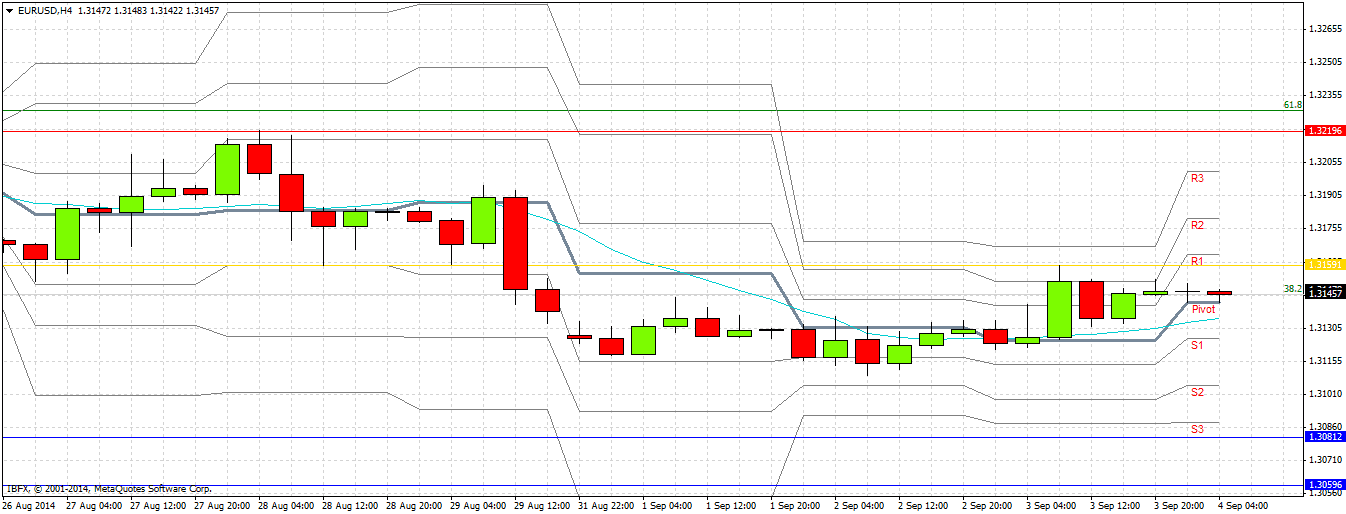

Short Trade 2

Short entry following a strong lower high after a major high once 1.3219 is broken to the up side.

Put a stop loss 1 pip above the local swing high.

Remove 75% of the position when profit is double risk and leave the remainder to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame after the first touch of 1.3081.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.3100.

Remove 75% of the position as profit at 1.3110 and leave the remainder of the position to ride.

EUR/USD Analysis

Yesterday was another quiet day, although it had a wider range than Monday and Tuesday. The bias was slightly bullish as USD strength tapered off somewhat, although the recent EUR strength also fell yesterday.

In any case the market is awaiting a series of major news releases later today and tomorrow that should affect the price markedly. Before then, little should happen.

There are very high-impact data releases scheduled today concerning both the EUR and the USD. Regarding the EUR, the Minimum Bid Rate will be announced at 12:45pm London time, followed by an ECB Press Conference at 1:30pm. Concerning the USD, there will be the ADP Non-Farm Employment Change at 1:15pm, followed by Trade Balance and Unemployment Claims at 1:30pm, and then finally ISM Non-Manufacturing PMI at 3pm. It should be a very volatile day, especially if there are any surprises.