EUR/USD Signal Update

Yesterday’s signals were not triggered and expired.

Today’s EUR/USD Signals

Risk 0.75% of equity.

Entries may be made only from 8am to 5pm London time today.

Short Trade 1

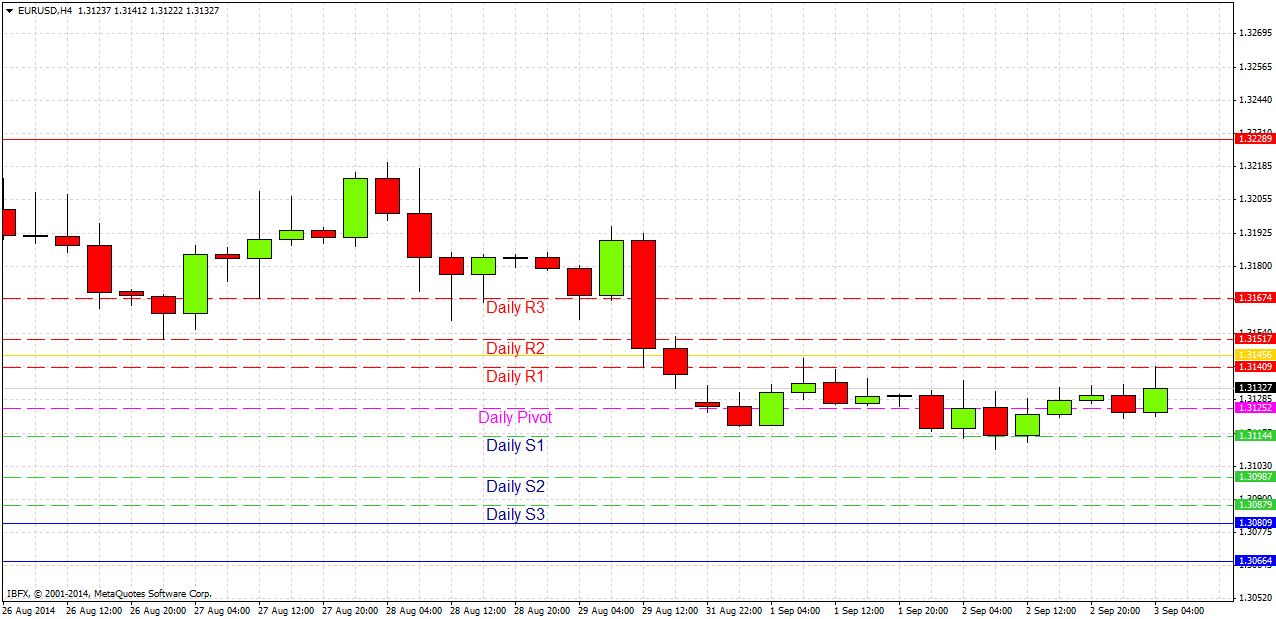

Short entry following a strong lower high after a major high once 1.3145 is broken to the up side.

Put a stop loss 1 pip above the local swing high.

Remove 75% of the position when profit is double risk and leave the remainder to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame after the first touch of 1.3081.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.3100.

Remove 75% of the position as profit at 1.3143 and leave the remainder of the position to ride.

EUR/USD Analysis

This week’s range has been extremely narrow: barely 35 pips. The main story so far of this week has been strength in the USD. This has not been expressed in a continuing move down because the EUR has been, surprisingly, almost as strong as the USD this week, which is why we are not getting much movement in this pair.

The two daily candles that have printed so far are basically slightly bullish dojis and the flow on shorter time frames is also bullish. This suggests we are more likely to break upwards first, but that may well be followed by a continuation of the downwards trend.

There are very important news releases due for both sides of this pair on Thursday and Friday, therefore in anticipation today is likely to be extremely quiet and without much opportunity.

There are no high-impact data releases scheduled today concerning either the EUR or the USD. Additionally, crucial news for both currencies is expected later this week, so today is likely to be a quiet day for this pair.