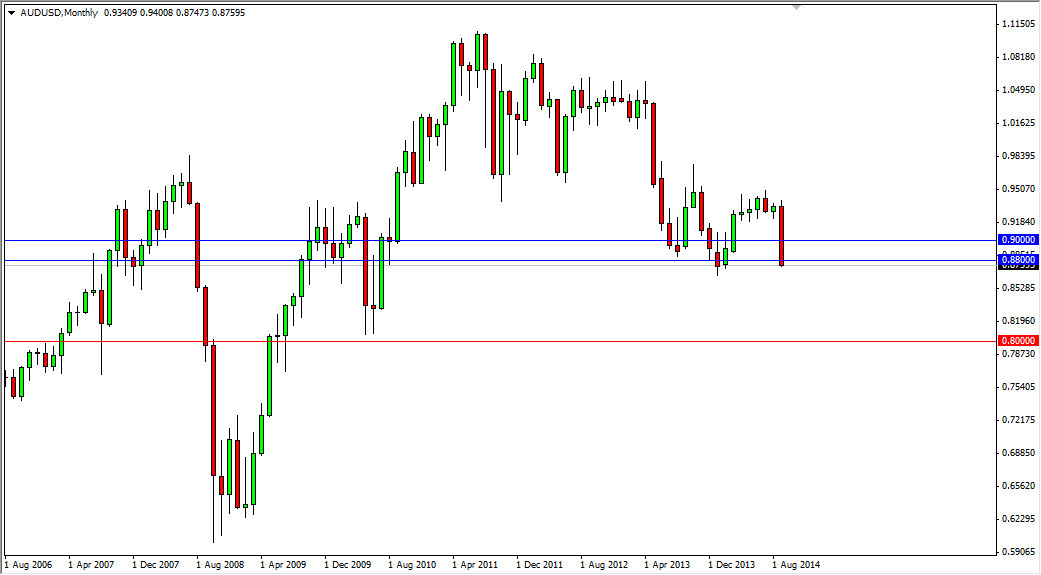

The AUD/USD pair had a nationally horrible month for September. We sliced through the 0.90 level first, and then crashed through the 0.88 level next. Because of this, the Australian dollar looks very susceptible to selling at this point in time, and with that I believe that if we get below the 0.87 level, there’s not a whole lot to keep us from going to the 0.80 handle given enough time.

With that, I believe that the marketplace should continue to offer plenty of selling opportunities with enough bearish pressure to continue selling every time we rally. The rally of course suggests that it is simple relief, as the markets have been drifting lower time and time again.

Ultimately, I believe that the gold markets are working against the value the Australian dollar as well. Let’s face it, very few commodity markets are going well at this point in time, and as money flows towards the US dollar, it will drive down the value of the commodity markets in general, which has a knock on effect to the Australian dollar as well.

Tightening monetary policy.

There is tightening monetary policy coming out of the Federal Reserve in the form of quantitative easing being cut off. That changes everything and as a result I feel that this market should continue to drop from here. I would anticipate another red candle for the month, as this market should continue to be sold off time and time again.

The candle is very negative and long, so it tells me that this breakdown of course is the real deal, and should continue. After all, it’s rare to see a candle close at the very bottom of the range and not to see continued bearish pressure. With that, I feel that this market will more than likely find the 0.85 level by the end of the month at this rate. It is not until we get above the 0.90 level that I would even remotely consider buying this pair, and even then I would be a bit cautious.