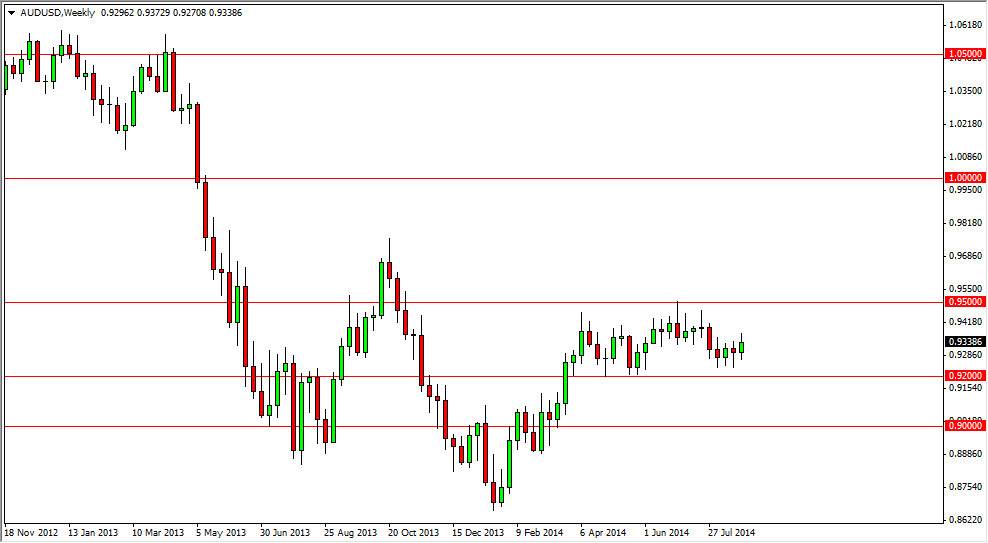

AUD/USD

The AUD/USD pair had a slightly positive week over the last five sessions, but remains well within the consolidation area that I have marked on the chart. I believe that this market will continue to bounce around between the 0.92 handle, and the 0.95 level. With that, I think that shorter-term trading will probably be the norm, but I do think there is a little bit more of an upward bias in the short-term. Nonetheless, I will be taking short-term trades only.

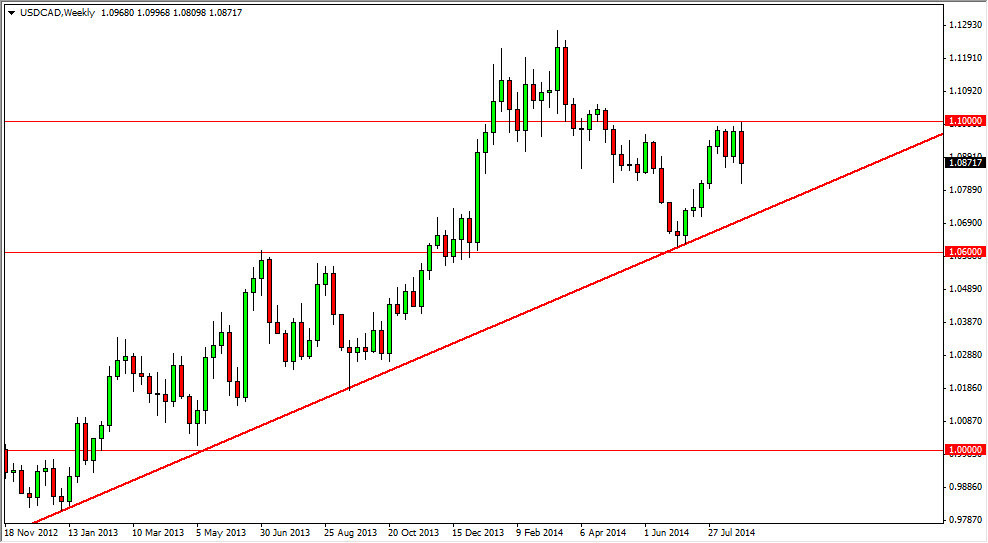

USD/CAD

The USD/CAD pair fell during the bulk of the week, but initially trying to break above the 1.10 level. That area is a massive resistance barrier, and it appears that we are trying to build up enough pressure to break above it in order to go much higher. However, the candle from this past week shows just how difficult that’s going to be, and with the uptrend line below it I feel that the market could pull back a little bit but find buyers below in order to start going long again. Ultimately, I have no interest in shorting this market until we get well below the uptrend line, something that I don’t anticipate seeing in the near term.

EUR/USD

The EUR/USD pair had another negative week, albeit less drastic than the one before. At the end of the day though, I think that the 1.30 level will be targeted fairly soon, and I will be shorting any short-term rallies that appear. In fact, I believe that the 1.30 level isn’t the bottom, I have that reserved for the 1.28 level as it is more important on the longer-term charts. I have no interest in buying this market until we get well above the 1.33 handle, something that I don’t anticipate seeing over the next couple of weeks. The Euro itself is in trouble, and we will get some economic announcements out of the EU this week they could show whether or not deflation is a real concern. The more deflationary the European economy looks, the more likely quantitative easing comes out of the ECB.

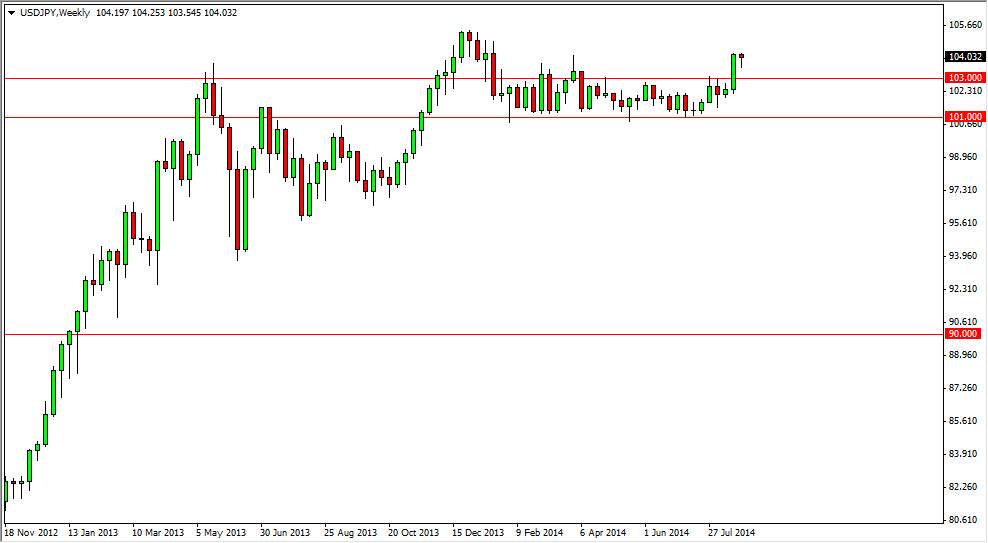

USD/JPY

The USD/JPY pair fell during the course of the week, but it must be said that we found a significant amount of support near the 103.50 level. In fact, we formed a nice-looking hammer at the top of a fairly impulsive move from the week before. That generally means that the market is ready to continue going higher, and they do think that we will test the 105 area. If we can get above there, the market should then head to the 110 level, which is my longer-term target anyway. That being said, I am buying short-term pullbacks in an effort to ride the wave higher.