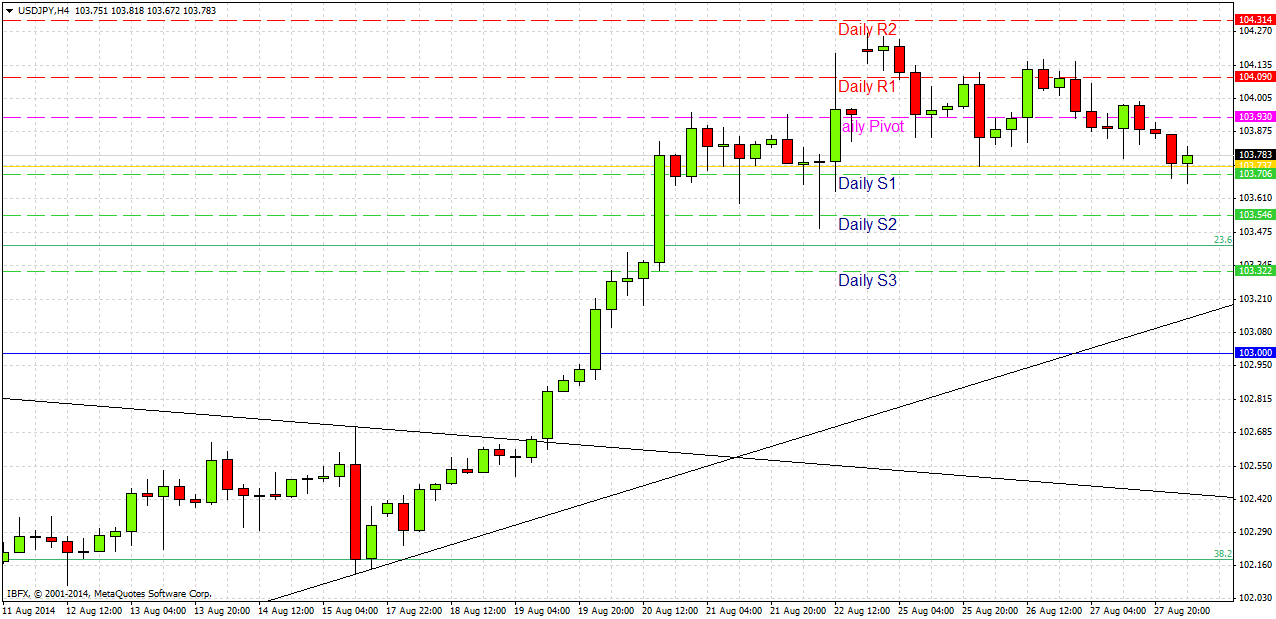

USD/JPY Signal Update

Yesterday’s signals did trigger a potential long trade a short while ago on a higher low after the price had fallen below 103.74.

Today’s USD/JPY Signal

Entries must only be taken before 8am London time tomorrow (Friday).

Risk 0.75% of equity.

Long Trade 1

Go long following bullish price action on the H1 time frame after the first touch of 103.00.

Put a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 103.40.

Remove 50% of the position as profit at 103.40 and leave the remainder of the position to ride.

Long Trade 2

Go long following a strong higher low fairly close to 103.74.

Put a stop loss 1 pip below the local swing low.

Remove 75% of the position when profit is twice risk and leave the remainder to ride.

USD/JPY Analysis

Yesterday I anticipated that we would not be able to break below 103.50. The picture is still bullish.

We dipped below 103.74 overnight, so it is now possible to look for long trades after we made a strong first higher low on a short-term chart.

If that does not happen and we fall instead to 103.50 after making a new low for the day, this could be an excellent level for the price to turn around bullishly and provide us with a long trade.

There is no very obvious resistance before the 105.00 level.

There are no high-impact data releases schedules for a specific time today concerning the JPY. Regarding the USD, there will be Preliminary GDP and Unemployment Claims at 1:30pm London time, followed by Pending Home Sales at 3pm. Therefore the New York session is likely to be more active.