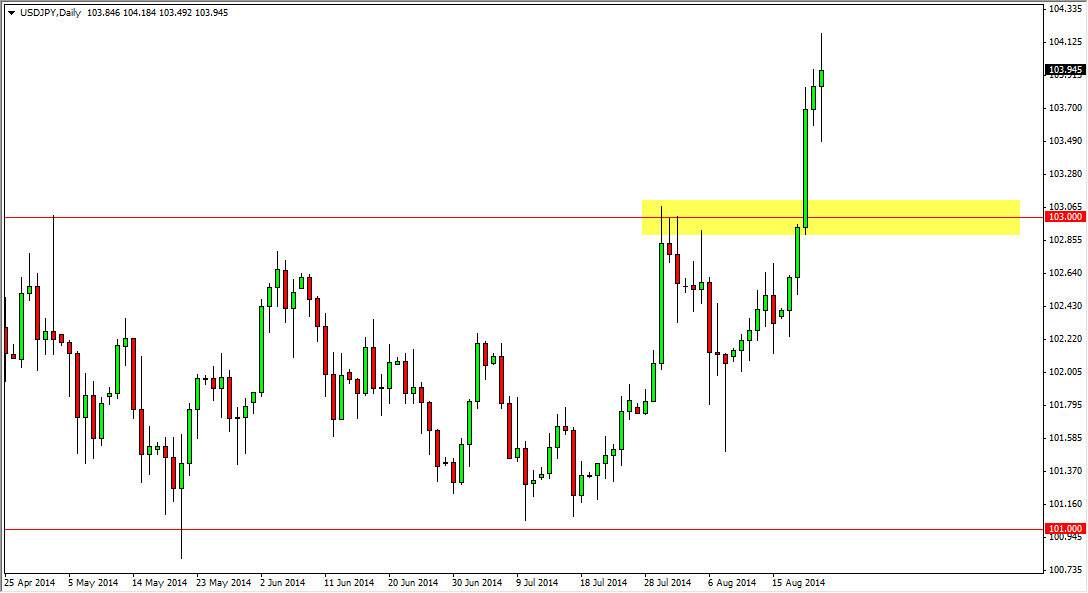

The USD/JPY pair had a pretty volatile session on Friday, as the market shot above 104, pullback, and then shot higher. We closed just below the 104 level at the end of the day, and as a result I believe that the market is trying to get above that handle. However, the volatility that I see in this candle on Friday suggests that the market will be struggling at this point to go higher. It doesn’t really matter to me though, because the 103 level is an area that had been resistive, and now should be supportive as “what was once the ceiling should now become the floor.”

That break out was of course something that caught my attention, and I believe now we should see plenty of buyers do the same thing somewhere near that area. Supportive candles between here and the 103 level is reason enough to go long, just as a break above the range of the Friday session would be. I believe that the next target is going to be 105, which should be a pretty significant barrier going higher. Ultimately though, I believe that we will break above there as well.

Bank of Japan and its monetary policies.

The Bank of Japan continues to keep its monetary policy very loose, while the Federal Reserve is looking to tighten its quantitative easing policy. This allows for the US dollar to appreciate in value, and should continue to be that way as long as the US economy continues to look like it’s one of the better ones out there.

Ultimately, I believe that this is a longer-term “buy-and-hold” type of situation, but expect a lot of choppiness between here and the 105 level. The interest-rate differential should continue to widen between the two currencies, and therefore the US dollar should continue to gain against the Japanese yen. On top of that, the Bank of Japan wants to see the Nikkei rise overall, and a loose monetary policy should force money into that market, making this market almost assured to go higher.