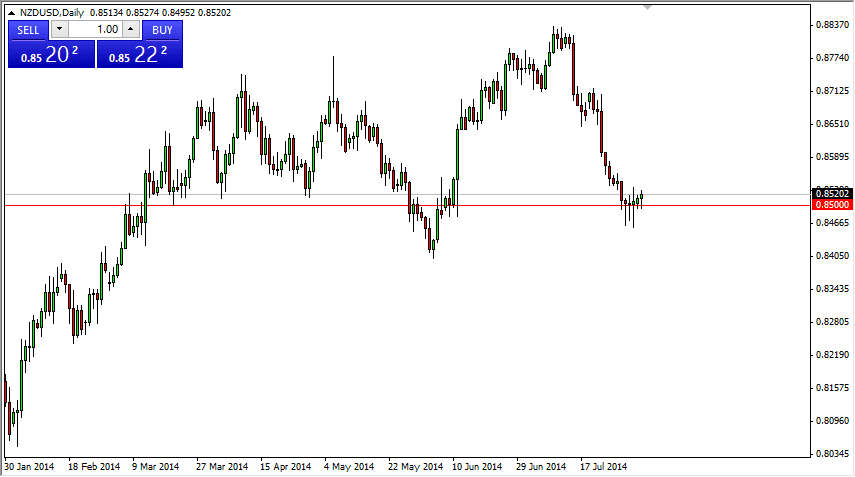

The NZD/USD pair initially fell during the course of the day on Monday, but as you can see the 0.85 level data in fact offer a bit of support. Because of that, I believe that this market is getting ready to bounce, and perhaps head back towards the 0.88 handle, which of course has been the top of recent consolidation. With that, I believe that this market can be bought on a break above the top of the range for the session. In fact, it makes sense considering that the Australian dollar suddenly looks like it could go a bit higher as well, as the two currencies tend to move hand-in-hand.

That being said, I believe that the move will be a bit choppy, and ultimately one that should be thought of more or less as a longer-term trade than a short-term trade as the markets certainly will continue to struggle going higher in this type of trading environment overall.

A return to consolidation

I believe that this is a return to consolidation in general, so I don’t think that we will break above the 0.88 level, but rather just find our way back to it. Ultimately, I believe that the New Zealand dollar goes much higher, but without the liquidity that we normally have, as August is such a slow month, I find it difficult to believe it’s going to happen anytime soon. Once the larger traders come back into play, it is possible that we could then see this market breakout which would be sometime in September.

Nonetheless, you have to look at both sides of the equation, and I believe that a move below the 0.84 level would send this market down to the 0.80 handle given enough time. That area is a significant support level based upon longer-term charts, and of course the fact that it is such a large, round, psychologically significant number. Nonetheless though, I don’t think it’s going to happen anytime soon and I am very bullish at the moment.