The XAU/USD pair had a relatively tight range yesterday as investors try to digest last week's downswing. Diminishing geopolitical concerns and speculations that the Federal Reserve is leaning toward raising interest rates caused investors’ confidence in gold to erode. As a result, the precious metal dropped about 2% since last Monday. Recent data on the economic front confirms that the United States continues to outperform other parts of the world and that is moving stocks higher.

In the Middle East, there are efforts being made particularly by Egypt to clear the obstacles in the way of an Israel-Hamas ceasefire. Russian President Vladimir Putin and his Ukrainian counterpart, Petro Poroshenko, will attend talks with EU representatives today but I don't think hopes are too high. Because of that, I will be paying more attention to the technical levels.

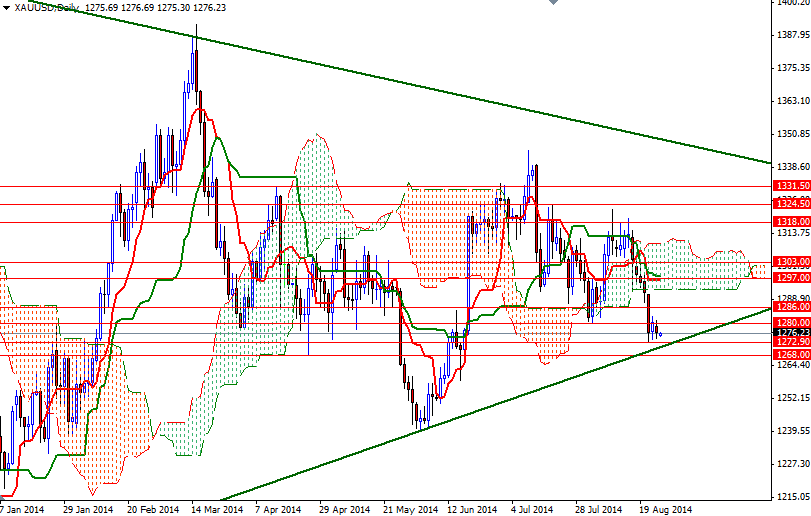

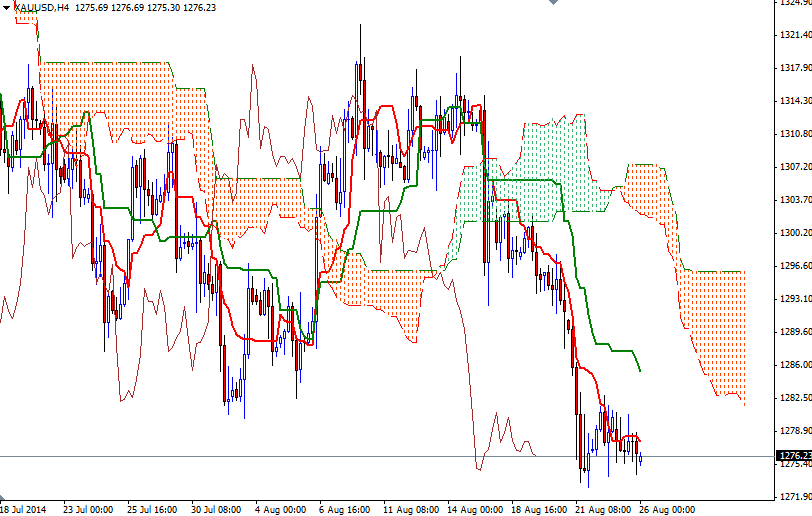

Speaking strictly based on the charts, the location of the Ichimoku clouds on the daily and 4-hour time frames shows the bears are still in charge and there are strong resistance levels to the upside. Bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on both charts also give an advantage to sellers. If the downward pressure continues and prices break below the 1273/68 support zone, then it is entirely possible to see the pair testing the support around 1259/4. Closing below this support would increase speculative selling and drag the market towards 1246.80. However, note that the market has been trying to form some sort of floor for the last three sessions. In order to regain their strength and march towards the 1292.70 level, where the bottom of the daily cloud sits, the bulls will have to push the XAU/USD pair above the 1286 resistance.