The XAU/USD (Gold vs. the American dollar) settled slightly higher on Friday, marking the first rise in six trading sessions, as resurfacing Ukraine jitters lead some investors to take profit off the table. Valentyn Nalyvaychenko, the head of Ukraine’s security council, said that Russia sent a convoy of trucks to eastern Ukraine without a Red Cross escort. NATO warned that by moving more of its own troops to the border the Russians can prevent Ukrainian troops from establishing control over the border and facilitate the delivery of new weapons to the separatists.

The speech by Yellen at the Kansas City Fed’s economic symposium was more balanced than expected. She said "If progress in the labor market continues to be more rapid than anticipated by the Committee or if inflation moves up more rapidly than anticipated, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target could come sooner than the Committee currently expects and could be more rapid thereafter. Of course, if economic performance turns out to be disappointing and progress toward our goals proceeds more slowly than we expect, then the future path of interest rates likely would be more accommodative than we currently anticipate". The market was looking for some more specifics in terms of timing but her words are still conditional. One thing is sure though, recent economic data intensified the debate among FOMC members over when to start rate hikes. In other words, flare-ups in geopolitical concerns and uncertainties in the major stock markets will continue providing a lift to gold in the short-term but long-term drivers will be the demand for the American dollar and economic growth.

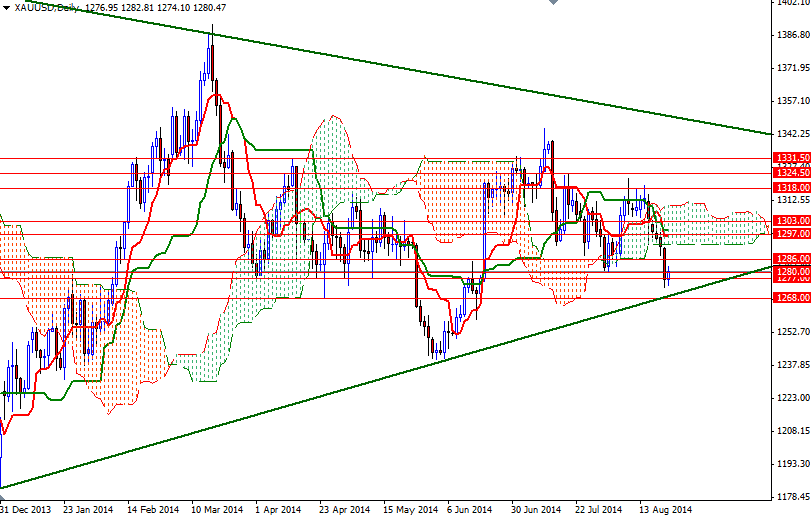

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 137976 contracts, from 147681 a week earlier. From a technical perspective, the broader directional bias remains weighted to the down side while the pair is trading below the Ichimoku clouds and the Tenkan-Sen line (nine-period moving average, red line) is below the Kijun-Sen line (twenty six-day moving average, green line). However, at this point, the support around 1268/6 will be something to watch. I think a sustained break below this level is essential if the bears want to march towards the 1240 level. On its way down, support can be found at 1258 and 1251. If the bulls manage to break and hold above the 1286 level, they might have a chance to test the resistance at 1292.70.