Gold weakened against the American dollar for the first time in four sessions after the Labor Department's report revealed that concerns about inflation were insubstantial. The XAU/USD pair accelerated its descent after breaching the $1303 and traded as low as $1292.28 but news of a Ukrainian artillery strike on a Russian military unit triggered some safe-haven interest. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 147681 contracts (the highest level in five weeks), from 121463 a week earlier.

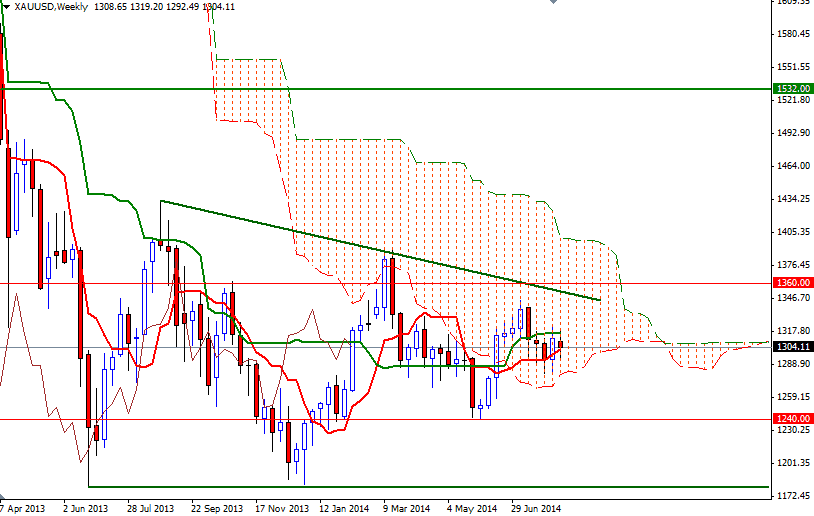

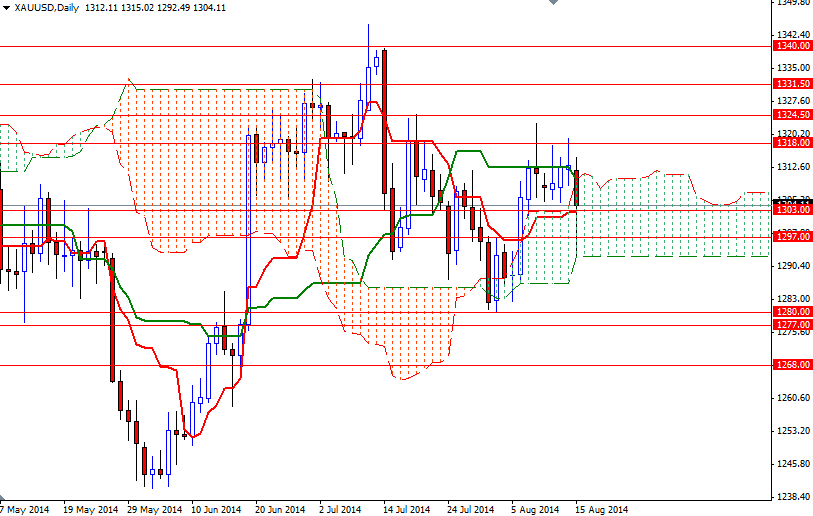

It looks like conflicts in different parts of the world will continue providing a lift to gold in the short-term but long-term drivers will be the Federal Reserve's plans on interest rates and economic growth. From a technical perspective, there are two things to pay close attention. First of all, the pair currently reside inside the Ichimoku clouds on the weekly, daily and 4-hour time frames. The next thing is the inside bar on the weekly chart (as you can see, the entire weekly trading range was within the price range of the previous week).

Bouncing off of the 1292 support level (which happens to be bottom of the daily cloud) and closing above the 1303 level make me think that lower prices continue to attract buyers. However, if the bulls intend to charge towards the July high of 1344.92, I think breaking through the 1318 - 1324.50 area is essential. Support to the down side can be found at the 1297 and 1292 levels. If the XAU/USD pair closes below 1292, it is likely that we will see the market testing the next support level at 1280.