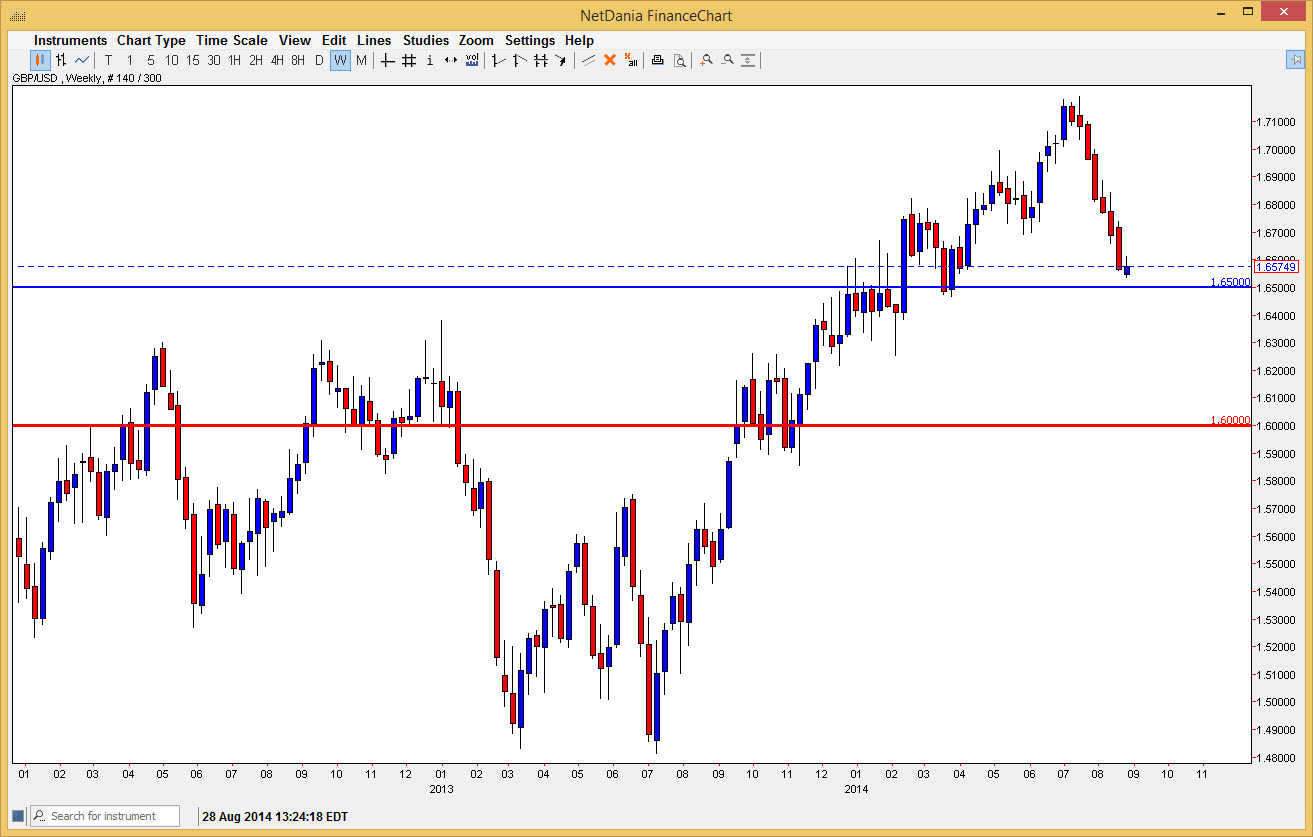

The GBP/USD pair has sold off rather drastically, as the US dollar continues to be one of the most desired currencies in the world at the moment. With this, I am looking at the 1.65 level as the first serious battleground that could protect the value of the British pound. However, if we get below the 1.64 handle, I think we will ultimately go down to the 1.6250 region, and then the 1.60 level. It’s hard to tell whether or not that’s going to happen, but I have to admit that the bearishness so far really have surprised me. I think that there is a significant amount of selling pressure going forward, and it would not surprise me at all to see them breakdown.

However, we could of course bounce but I believe that ultimately we will need to see some type of supportive weekly candle in order to get convinced. After all, you have to think that we have sold off rather drastically over the last two months, so a bounce truly is possible.

Serious fight in September.

There is speculation that the Bank of England will have to cut back on some of its quantitative easing, so even if this pair falls it’s possible that the British pound will do better against the US dollar than many of the other currencies out there. If that’s the case, then you should see this market “fall less.” That being said, you can also triangulate both this market and the GBP/USD pairs, thereby figure out how to trade the EUR/GBP pair. After all, this market could be very sticky on the way down as there are a couple of different serious support areas.

At the end of the day though, I do prefer the US dollar in general, so I’m not necessarily looking to buy the British pound unless of course I get some type of supportive weekly candle which could signify that perhaps the British pound itself might be a little bit of an outlier compared to other currencies versus the dollar.