GBP/USD Signal Update

There are no outstanding signals.

Today’s GBP/USD Signals

Risk 0.75%.

Entries may be made only between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame following a first touch of 1.6808.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6890.

Remove 75% of the position as profit at 1.6890 and leave the remainder of the position to run.

Short Trade

Short entry following bearish price action on the H1 time frame following a first touch of 1.6890.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.6810.

Remove 50% of the position as profit at 1.6810 and leave the remainder of the position to run.

GBP/USD Analysis

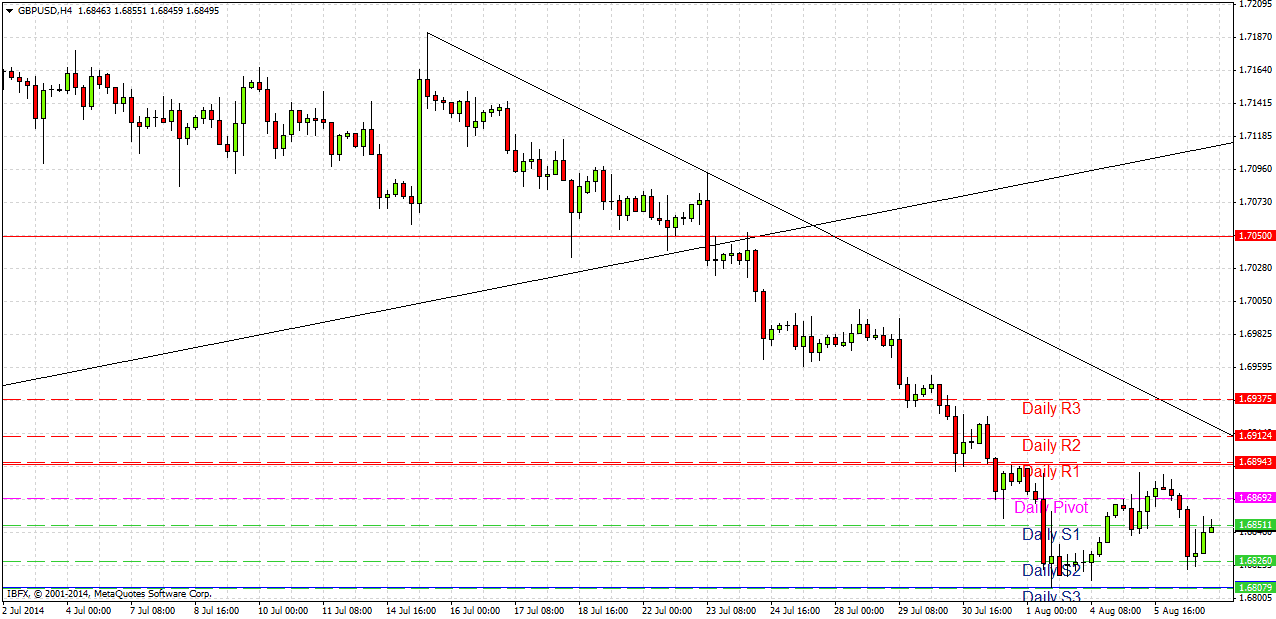

Following a multi-year high which this pair made in early July, it has been falling quite steadily due to both recent USD strength and a feeling in the market that the GBP had gone as far as it could go for now, after a very impressive bull run that had lasted more than a year.

However there has been some bullishness in recent days, with a bottom forming at 1.6808. This level acted as both support, then resistance during May and June when the price was last here.

If this bottom holds we should be due for a more meaningful upwards correction. Watch out for the bearish trend line shown in the chart below above the current price, as well as likely resistance at the 1.6893 level.

There are high-impact data releases due today concerning both the GBP and the USD. At Noon London time the Bank of England will announce the Asset Purchase Facility and the Official Bank Rate. Later at 1:30pm there will be a release of US Unemployment Claims data.