EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries must be made before 5pm London time today.

Long Trade

Go long following bullish price action on the H1 time frame after the first touch of 1.3325.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.3440.

Take off 75% of the position as profit at 1.3440 and leave the remainder of the position to ride.

Short Trade

Go short following bearish price action on the H1 time frame after the first touch of 1.3442.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.3325.

Take off 50% of the position as profit at 1.3325 and leave the remainder of the position to ride.

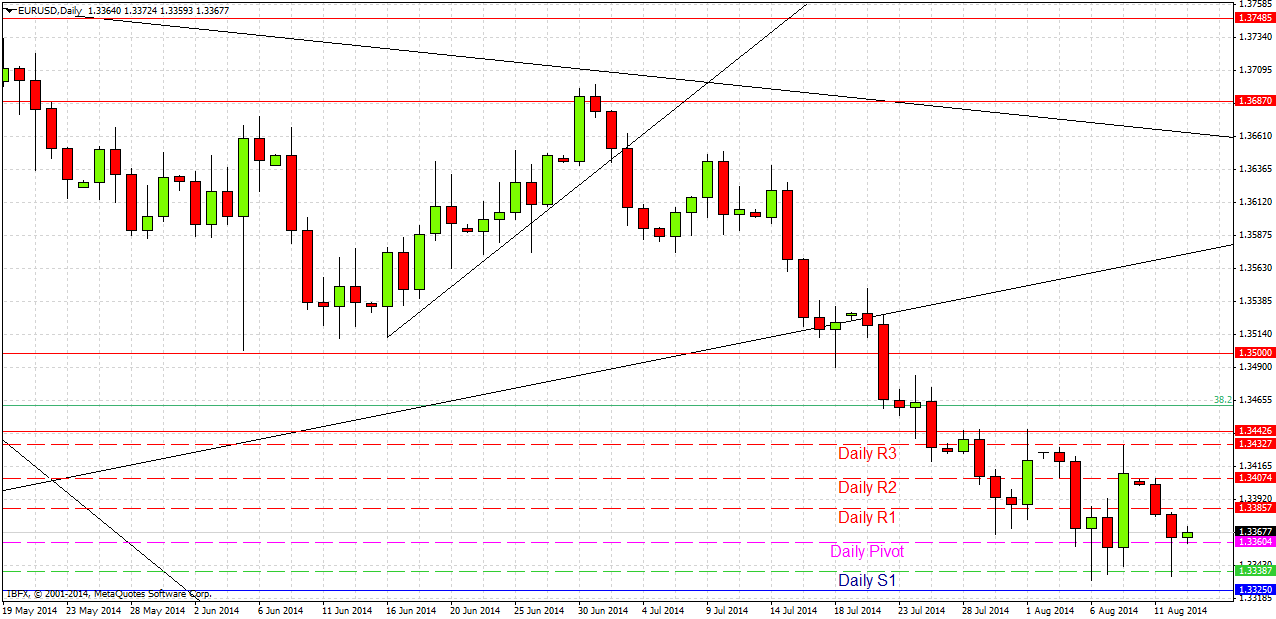

EUR/USD Analysis

Neither of the closest key support and resistance has been touched yet this week. As expected, we did get a move down yesterday towards the support at 1.3325, but the price turned around a few pips short of the level and rose again. Looking at the daily chart below, it seems that we are might be carving out some kind of bottom close to 1.3325 which suggest the next move will be upwards. If this happens and we can break 1.3442, we are likely to pull back as far as 1.3500.

There are no high-impact data releases due today concerning the EUR. Regarding the USD, there are Retail Sales data due at 1:30pm London time. Therefore it is likely that we will have a quiet London session before New York opens, when things should get livelier.