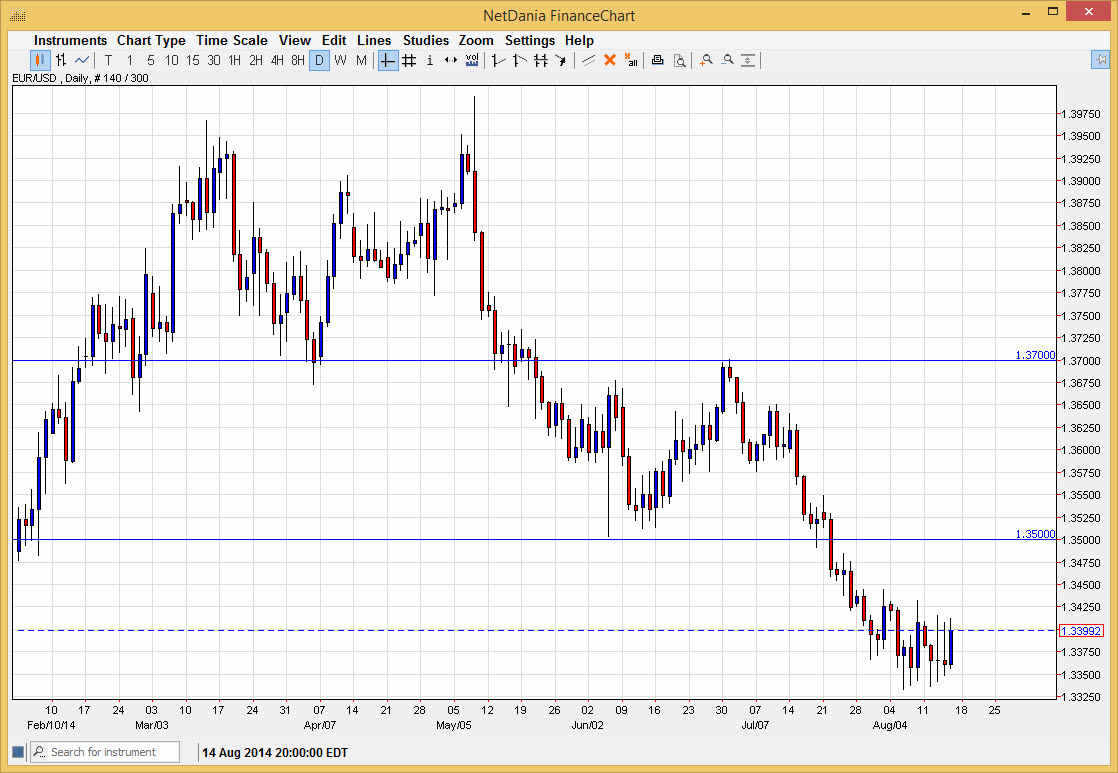

The EUR/USD pair rose during the session on Friday, testing the 1.34 level yet again. That being said, the market did close just below that handle, something that it is not been able to do for several sessions because of that, we feel that the market is more than likely going to continue going higher, trying to reach significant resistance areas at the 1.3450 handle, and most certainly of the 1.35 handle. With that being the case, the market looks as if it’s ready to go to the 1.35 handle given enough time, and therefore I believe that we should have a decent selling opportunity near that handle.

The 1.35 level should be significantly resistive, and it is not until we get above the 1.3550 level that I am comfortable to start buying this market. Because of that, I am actually letting the market bounce a bit from here, and looking for some type of softening of the move higher in order to start selling. The trend is most certainly negative overall, and as a result there’s no way to start buying this market in this general vicinity.

Major level at the 1.35 handle

I believe that the 1.35 level needs to be broken well above in order to even think about changing the trend, and although that would be a bit of a trend change, the reality is that the market should simply consolidate between the 1.35 handle and the 1.37 handle at that point, so really it’s not even something that you can place money into the market for a longer-term move.

Looking at this chart, I think more than likely we should see the market head back down towards the 1.33 handle given enough time, and given enough selling pressure. The 1.33 level of course is a large and long-term buying and sell level, as the market has reacted both ways over time. The market tends to return to these levels time and time again, so I feel that we need to hit the 1.33 handle in order to continue going forward. The real question is whether or not we bounced first or if we just simply fall straight back down?