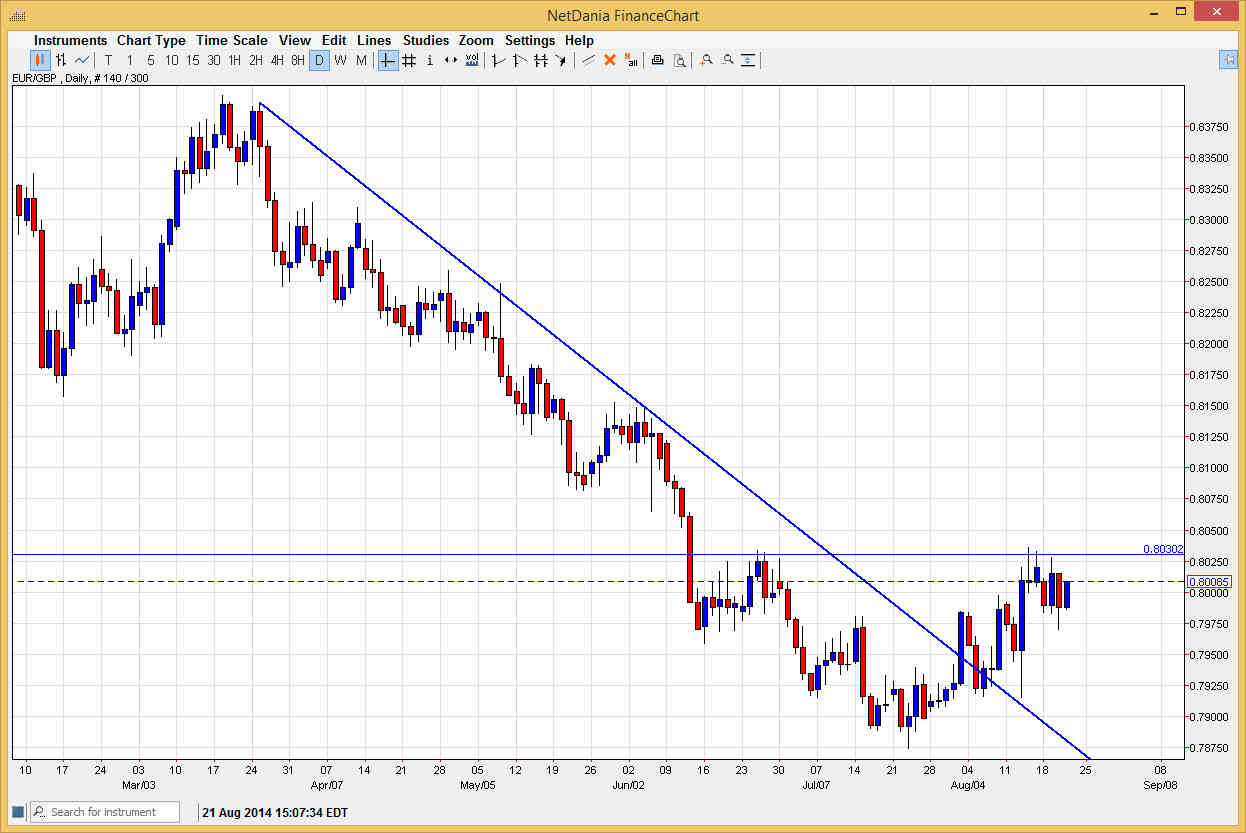

The EUR/GBP pair had a positive session on Thursday, as we broke back above the 0.80 level again. However, it appears that we are essentially grinding away just below the 0.8030 level, and as a result were trying to build up enough momentum to break out to the upside. If we do get above there, we feel that the trend has changed, as we have not only broken a downtrend line, but we have broken above the previous high, and therefore by its very definition, the pair has broken the downtrend. That being the case, I would start buying at roughly 0.8050, and hang on for about 300 pips or so.

Don’t get me wrong, I believe that this market will be a bit choppy from time to time, but it is more or less a long-term type of situation that I am looking at. With that, I think that the market will be more or less a “buy-and-hold” type of situation, and with that it’s very easy to imagine that short-term traders could come in and pick up this market every time it dips.

“Accumulation phase?”

Now I have to ask whether or not we are in the accumulation phase. If we are, this is where the so-called “smart money” start entering the marketplace and buying. I do have to admit that the longer-term charts show this general vicinity has been very important, and as a result it’s very possible that the monthly charts are leading the way. Again, if we can break above the 0.8050 level in my opinion is the “go signal”, and as a result we would more than likely have a long-term opportunity. The 300 pips that I mentioned previously in this article might just be the start, as we could go as high as the previous highs from several months ago.

On the other hand, on a fresh, new low, I would be a seller of this marketplace but I would also have to see the GBP/USD pair start going higher as well as it would show British pound strength.