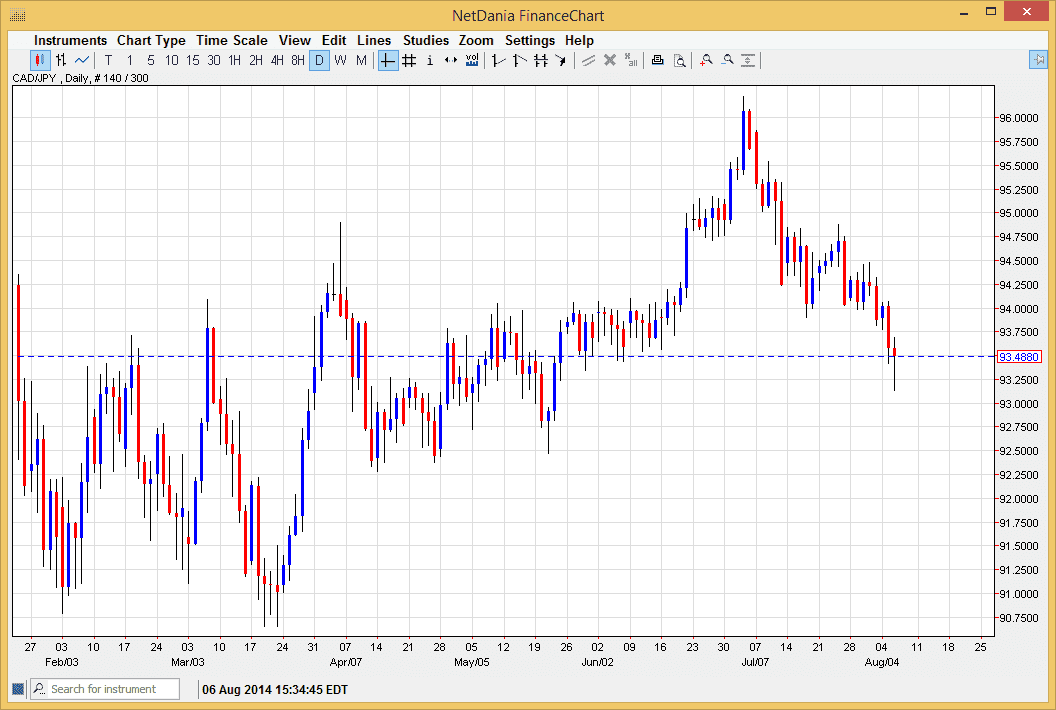

The CAD/JPY pair initially fell during the course of the day on Wednesday, but as you can tell the 93.20 level offered enough support to turn things back around and form a nice-looking hammer. This hammer of course suggests that the market is going to go higher from here, perhaps bouncing as we need to see some type of correction from the larger correction in order to continue the uptrend.

Ultimately, break above the top of the hammer should send this market looking to the 94 level for resistance, and if we can get above there 94.50 should be targeted right away. Ultimately, we could go as high as 96, but this of course will have major influence coming from the oil markets, which don’t necessarily look that strong at the moment.

I believe that the Canadian dollar continues to show weakness overall, but the Japanese yen is more or less a safety currency, so this probably will be more influenced by oil than the actual value of the Canadian dollar against most currencies. Also, keep in mind that the US dollar will influence the oil markets themselves, so you kind of have to pay attention all three markets.

Quite frankly, there’s a simpler way to play this.

I do know that there’s a simpler way to play this, and this is exactly why I used technical analysis. Instead of overthinking the three markets and trying to triangulate which should happen, I simply pay attention to what’s going on in the chart on my desktop. A move above 94 certainly bullish in this market, and I think could have is going much higher. I do recognize of this probably choppiness above, so really I believe that the buyers will step back into the marketplace every time this market dips, as it certainly is still bullish, even with the massive selloff over the last couple of months.

On the other hand, if we break below the 92.50 level, I think we go immediately down to the 91 handle, as that would be a significant break of support.