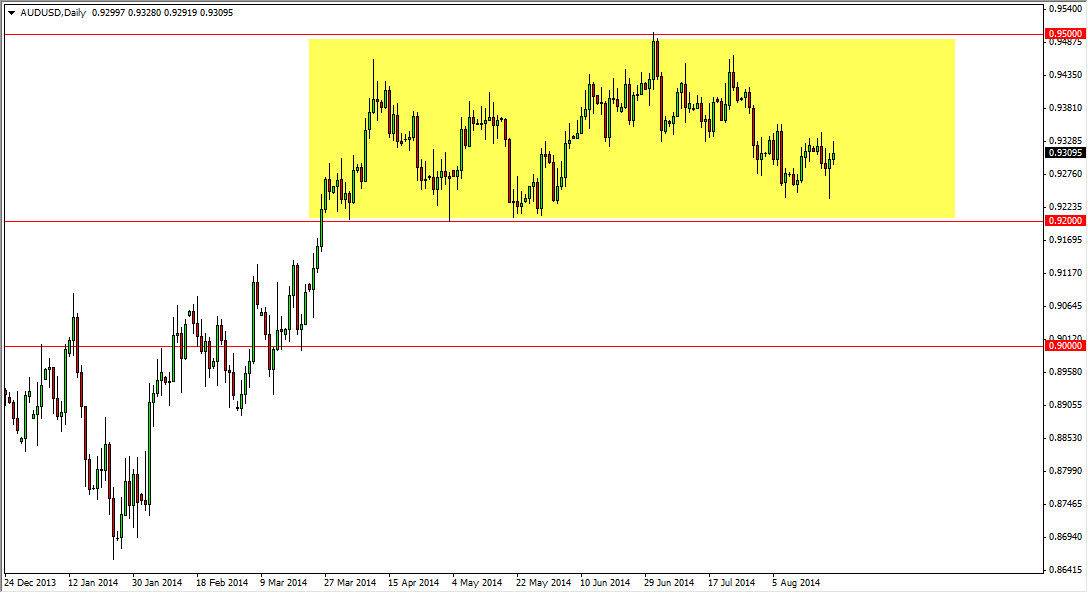

The AUD/USD pair rose during the course of the day on Friday, but gave back about half of the gains. What is more important to me is the fact that we broke the top of the hammer from the Thursday session, and the top of the shooting star from the Wednesday session. With that, I feel that the market should go higher, probably aiming towards the 0.9450 level. That level was the top of the recent consolidation area, and the 0.9250 level was the bottom. I believe that the levels both have 50 pips worth of sickness to them, meaning that the real support is all the way down to the 0.92 handle, while the real resistance is at the 0.95 level.

Ultimately, I think that since we are in the middle the summer, this market will continue to consolidate overall simply because there should be too much to push the market around. What I find interesting is that the gold markets have been falling while the Australian dollar has been rising over the next couple of days. That is a little bit of a divergence of the normality of the two markets, so that being the case I think that the Australian dollar might have a little bit of strength to it going forward.

We’re going sideways, until we don’t.

I hate to put it that way, but it is true. We are going sideways until we aren’t. We will eventually just breakout and get out of the consolidation area, but really it isn’t until we do so that there should be any discernible longer-term trend. Quite frankly, all you can do as play the range until your proven wrong, and at this point in time we have not been. I think that we continue to go back and forth and therefore I believe that we do go higher given enough time.

You have to be able to deal with the volatility, but at the end of the day I don’t see any reason why this market will continue as it has been going. With that, I am bullish, at least for the moment.