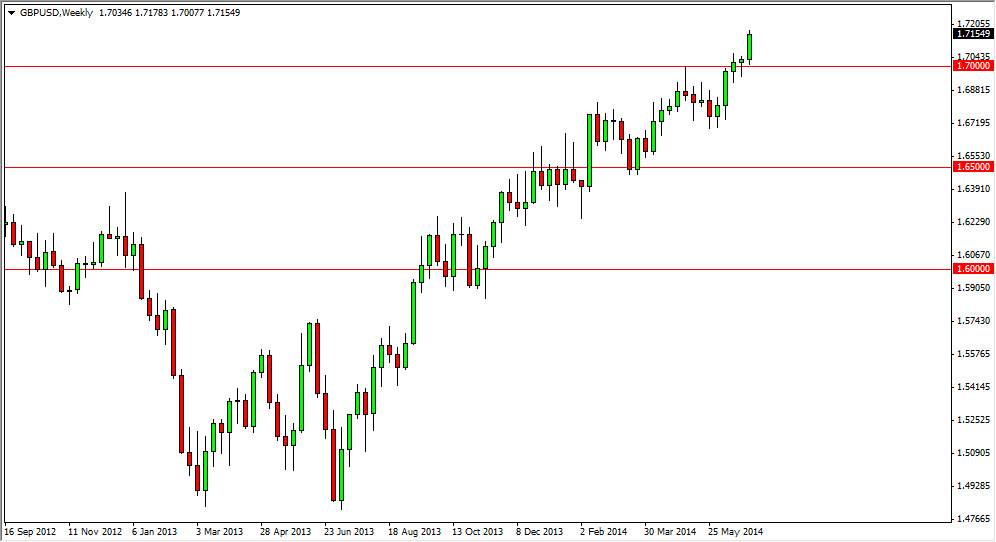

GBP/USD

The GBP/USD pair continued to impress me during the previous week, as we broke above the top of the hammer from the previous week, which of course was impressive in and of itself. After all, the market had broken above the 1.70 level and then retested it for support to form a hammer. That is about as good as it’s going to get for a buy signal, and as a result I have been very bullish of the British pound since that happened. The fact that we broke higher and just continue to climb suggests to me that this market will in fact reach the 1.75 handle given enough time. I have no interest in shorting this market now.

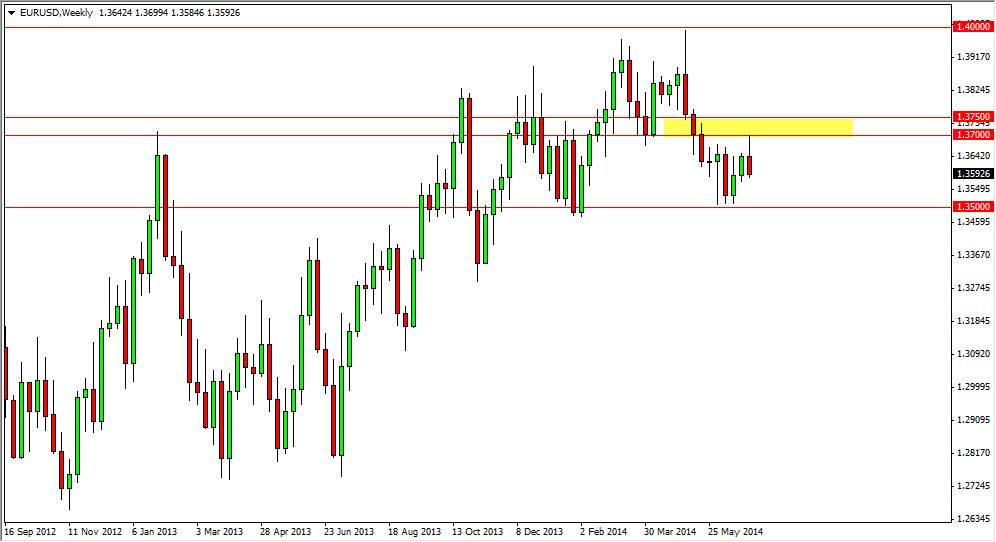

EUR/USD

The EUR/USD pair tried to break higher during the course of the week, but you can see that the 1.37 level offered enough resistance to keep the market down. We turned back around at that point and formed a shooting star, which of course suggests to me that we are probably going to fall from here. However, we have a significant amount of support at the 1.35 level, and that means that we probably are simply going to continue to consolidate. With that in mind, this looks like a pair that is still going to be more trouble than it’s worth.

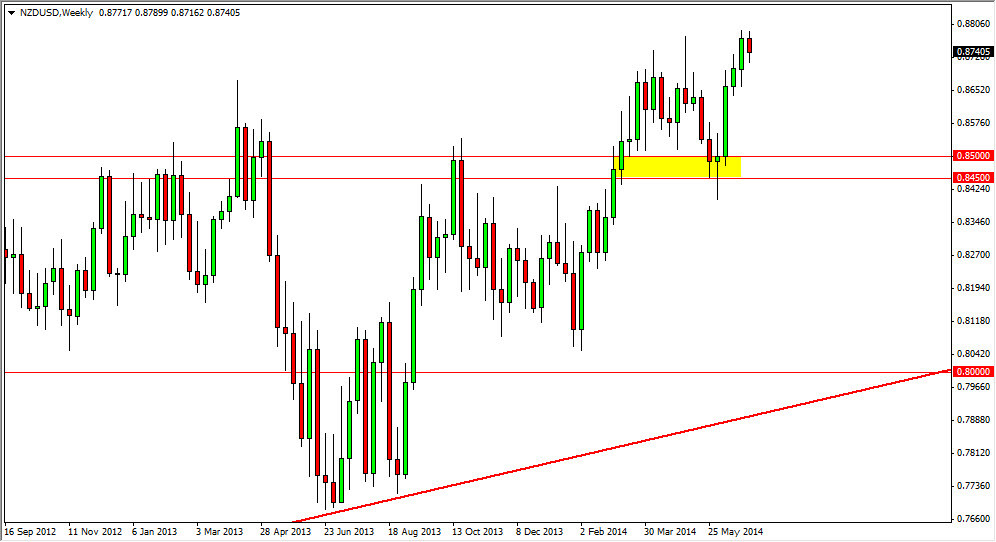

NZD/USD

The NZD/USD pair had a slightly negative week over the last five sessions, but if you look at the previous three candles, it’s easy to imagine that the market might be a little bit overbought at this point. However, I still believe that this market breaks above the 0.88 handle given enough time, and that we ultimately march towards the 0.90 level. I would look it pullbacks as potential buying opportunities as it should be a sign of “value” in the New Zealand dollar, and there should be a significant amount of support down at the 0.85 handle. Ultimately, I am very bullish of the New Zealand dollar, it’s just that it may take a little bit more time to actually get that break out.

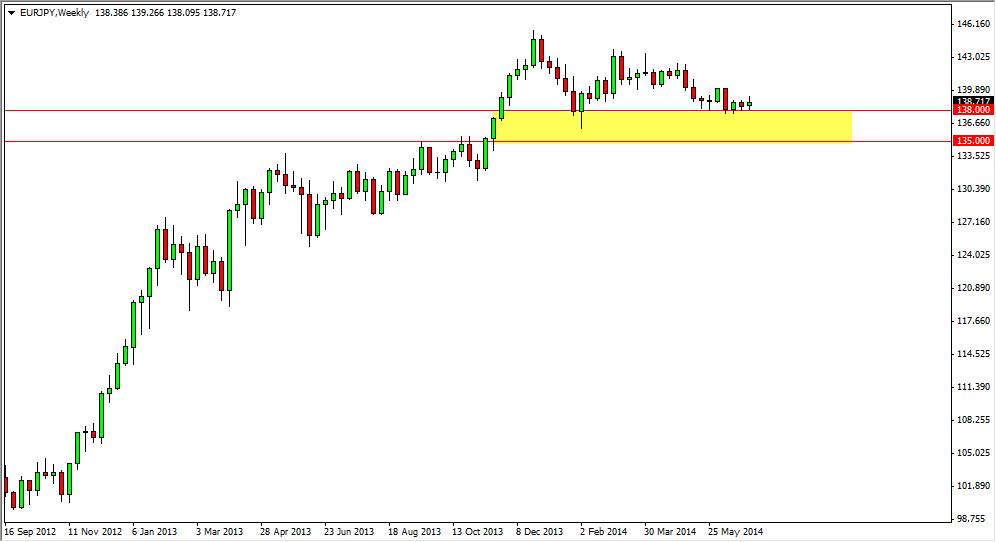

EUR/JPY

The EUR/JPY pair didn’t do much during the previous week, but what it did show us is that the 138 level is still in fact supportive. That’s a good sign, and I still believe that this market ultimately goes higher. Even if we fall from here, I have a hard time believing that the market gets below the 135 level. Longer-term, I see that this market should hit the 145 level, and probably the 150 level after that. I have no interest in shorting this market, at least until we get below the 135 level. I think and ultimately though, this market will continue the uptrend and it should be a nice buy-and-hold type of situation later this summer.