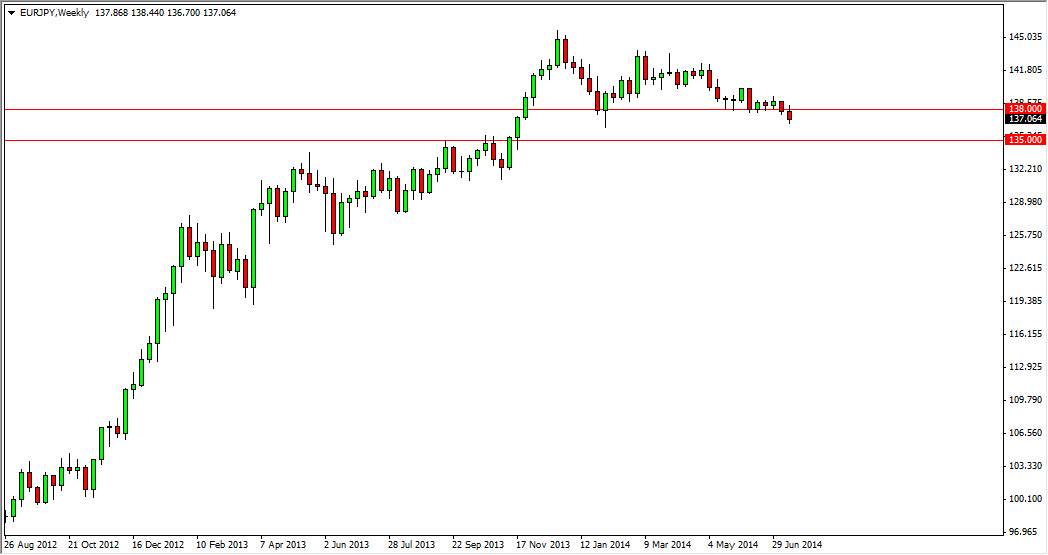

EUR/JPY

The EUR/JPY pair initially tried to rally during the course of the week, but as you can see the 138 level offered more than enough resistance to push the market back down. As you can see, the 1.35 level is marked on this chart, and I believe that the market is the next massive support level below. I think that the market is probably going to drift lower from here, but it should find plenty of support at the 135 handle in order for a bounce to occur. On the other hand, if we break the top of the range of this past week, that is also a positive sign, probably sending the market to the 142 handle.

EUR/USD

The EUR/USD pair fell during the course of the week, but still finds plenty of support at the 1.35 level to stay above it. If we can get below the 1.35 handle, I think that the market will more than likely head to the 1.33 handle, but there’s really nothing to suggest that the market will bounce from here, probably heading to the 1.36 handle as we have been very tight lately.

USD/CAD

The USD/CAD pair tried to rally during the course of the week, but the 1.08 level offered enough resistance to turn the market back around. With this, we pulled back to form a shooting star, but I still see a significant uptrend line that is just below and has been respected several times in a row. There is significant support at the 1.06 level as well, so I think that if we fall here we will more than likely find support at the uptrend line, and I would be more than willing to start buying on a supportive candle. On the other hand, if we break above the 1.08 level, that would of course be a very strong sign as well, sending the market to the 1.10 level.

NZD/USD

The NZD/USD pair fell hard during the course of the week, showing the 0.88 level to be resistive. The red candle is fairly long, so we think that there could be a little bit more selling pressure to the downside, but ultimately the market has plenty of support all the way down to the 0.85 level. That is the “floor” in the market as far as we can tell, and therefore we would be willing to buy a supportive candle between here and there. On the other hand, if we break above the 0.88 level, this market heads to the 0.90 level.