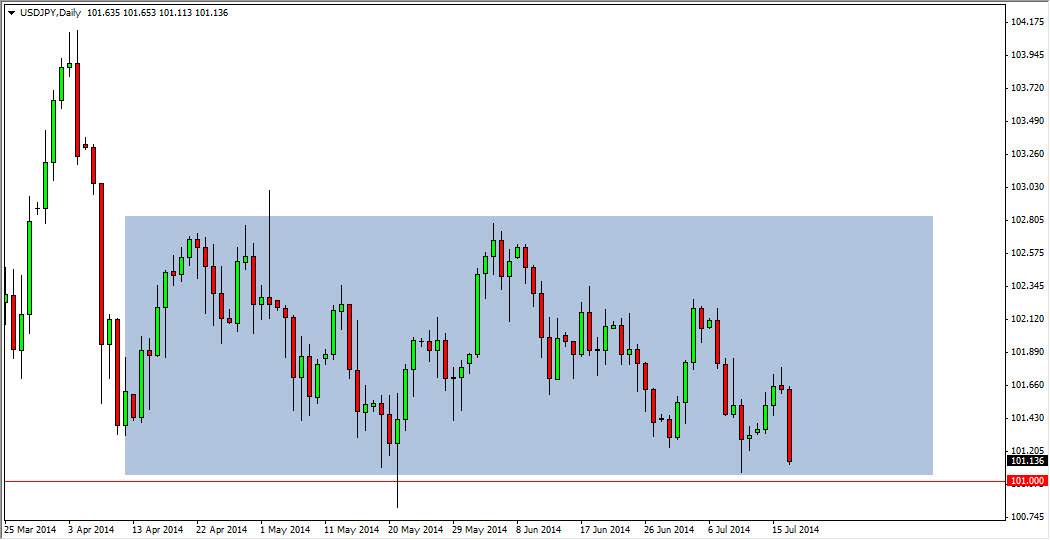

The USD/JPY pair ended up falling rather hard during the session on Thursday, but as you can see remains above the 101 level. It is because of this that I feel that the market will probably get a little bit of buying interest somewhere just below. After all, the support runs all the way down to the 100 level, and the fact suggests that it’s going to be very difficult to break down too much farther at this point. In fact, I believe that a supportive candle in this area would be an excellent buying opportunity, for a short-term trade obviously.

The market should continue to bounce around in this general vicinity as we are starting to head to the bulk of the summer trading months, but I believe that being patient is going to be the way to continue to make money. After all, trying to “jump the gun” in this marketplace is a good way to get her, especially when you’re trading the Japanese yen.

I’m starting to think 100 is a “line in the sand.”

I’m starting to think that perhaps the 100 level is a bit of a “line in the sand” in this market. I wonder whether or not it doesn’t have something do with the Bank of Japan, and its desire to have a weaker Yen. I can’t say that the Bank of Japan is stepping in and buying somewhere near the 101 level, but what I do know is that the market really is struggling to fall much farther than that area. With that, I think you have to assume that there is serious amounts of money underneath that are trying to keep the market somewhat afloat.

Ultimately, I believe that this market will try to bounce back towards the 102.50 level, but do not think that it’s going to be an easy move. This is a very volatile pair, and should continue to be so as far as I can see ahead. Short-term charts will probably lead the way to scalping this market over and over again for the next couple of months.