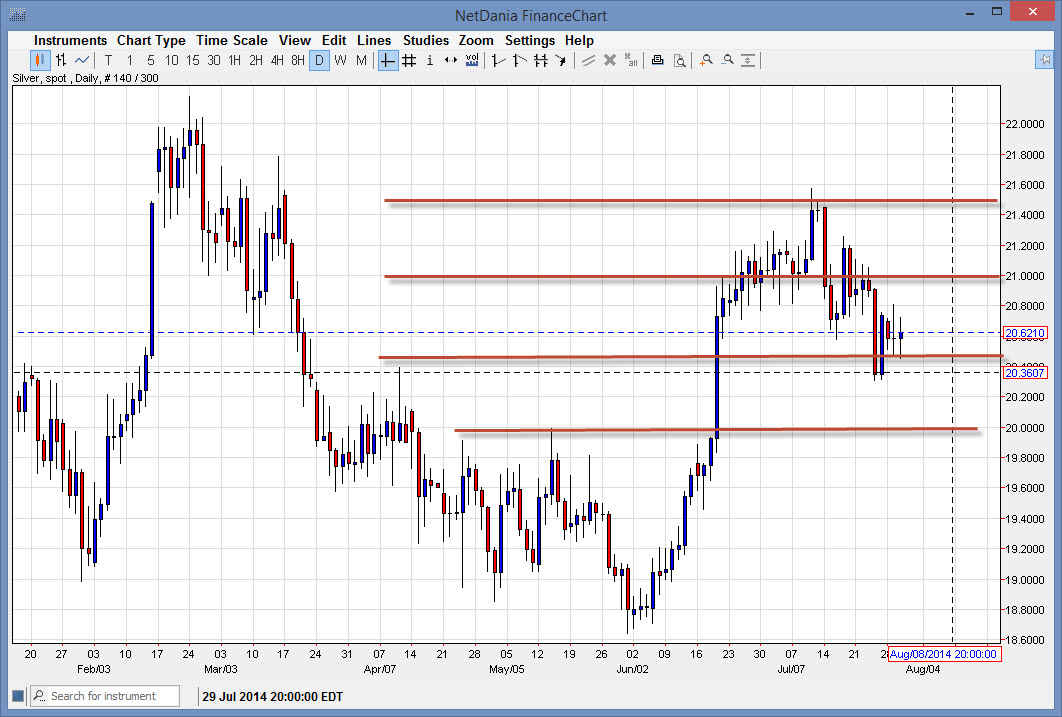

The silver markets as you can see went back and forth during the session on Wednesday, essentially settling nothing as we have formed the second neutral candle in a row. However, I also recognize that we are getting close to the nonfarm payroll number, which of course can have a massive effect on risk appetite in general, which of course has an effect on silver.

Silver is an interesting metal, because it is not only a precious metal, but an industrial one as well. So it’s possible that we see the market wait for the jobs numbers to see whether or not there could be demand going forward. After all, the theory is that the more jobs that are added, the more demand there will be for industrial commodities in general.

GDP numbers certainly suggests industrial demand could be picking up.

The GDP numbers akimbo much more robust than anticipated of the United States suggests that perhaps industrial demand for silver, and other industrial metals in general, could pick up. With that, I feel that the market is probably waiting on the jobs number to get a “bigger picture” type of consensus on what could be going to happen in the future.

As you can see, I have several lines on this chart. Notice that they are $.50 apart. Because of this, I like the silver markets from the short-term side as it is a very technical market, but you can see one that consolidates quite a bit with sudden and impulsive moves in one direction or the other. I think that the $20.00 level will continue to be very supportive, so I would be more than willing to buy down near that area. I also think that the $21.00 level will be very resistive above, so expect that area to keep the market somewhat down. However, once we get an idea of what the employment situation in the Americas are, we should see a more indicative and clear move. Don’t forget, part of the selloff in silver could very well have to do with the US dollar strengthening, which in the end that correlation should fade.