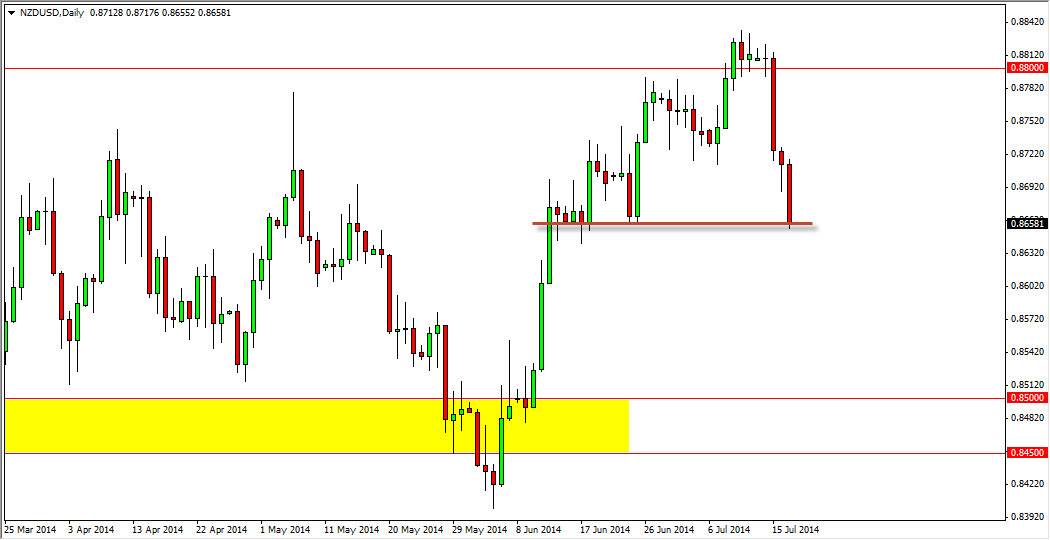

The NZD/USD pair fell rather hard again during the session on Thursday, breaking the back of the hammer that informed on Wednesday. Because of this, it appears to me that the market is breaking down a bit, but the 0.8650 level will have to be broken down below in order to start selling again. If we get below there, I see nothing on this chart that suggests that the market can get down to the 0.85 handle. I would expect quite a bit of support down there though, so I think this is more or less a short-term selling opportunity if we get it.

On the other hand, we could bounce from here but I do not like the candlestick formation and I have to admit that the move lower certainly leads me to believe that the market may need to calm down a bit before it’s worth risking any money and. Remember, the New Zealand dollar is one of the least liquid of the more major currencies, and as a result it does tend to move quicker than the others. Also, it is a very risk sensitive currency, and if there is a general fear growing in the marketplace, the New Zealand dollar will get absolutely pummeled for that.

Being patient is going to be the best way.

Being patient in this marketplace is probably going to be the best way to play it, and therefore I am waiting to see whether or not I get a nice supportive candle in order to start buying. The alternative would be a massive engulfing candle that overtakes the Thursday selloff, but quite frankly I don’t see that coming.

I would be comfortable shorting this market below the 0.8650 handle, but I recognize that the move would be rather quick. I have serious doubts that we can break down below the support area below, and I also think that buying down there is an excellent opportunity as well. Expect a lot of volatility, but be very careful with this pair as it looks like we are reaching a serious point of inflection.