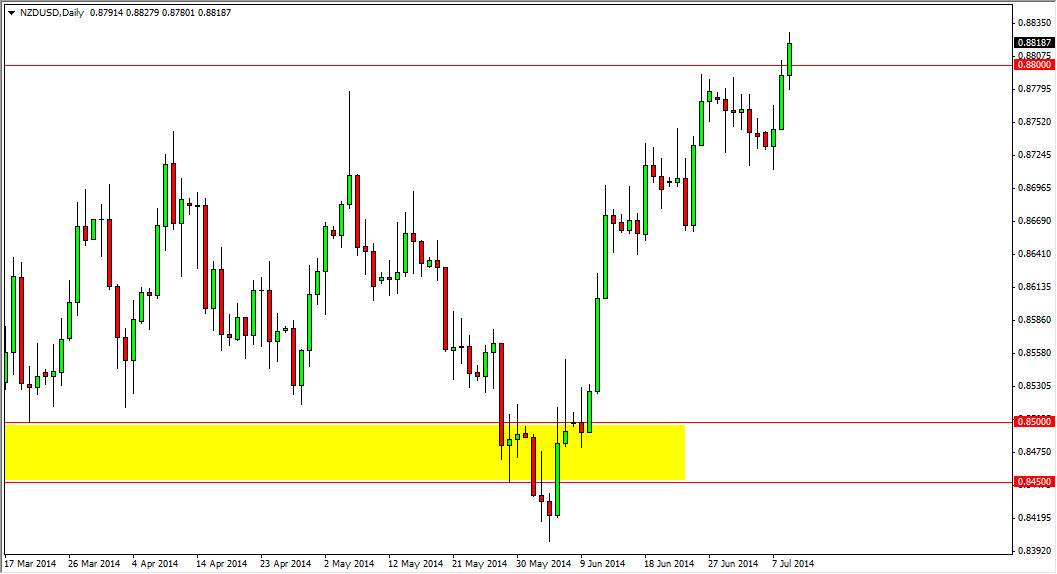

The NZD/USD pair initially fell during the session on Wednesday, but as you can see ultimately broke higher, clearing the 0.88 level order to break out from significant resistance. With that, the market appears that it is ready to continue going higher, and I believe that the next stop that we will see the market aim for is the 0.90 level.

The 0.90 level is significant on a longer-term chart, and it is a large, round, psychologically significant number. With that, it makes complete sense that the market would aim for it, and quite frankly I don’t see anything stopping us from going there at this point. We should continue to see significant support at the 0.88 level, an area that had been so stubborn for a couple of weeks. I believe that short-term traders will probably come back into this market place if we back down towards that level, and therefore I believe that you will have to look to short-term charts in order to find the entry candle.

On the other hand, there is the possibility that we break the top of the range for the session, and that for me is just as valid of a positive signal as that pulling back would be. The clustering of the marketplace just underneath the 0.88 handle should be continue to offer support even if we break down a little bit, and I do truly believe that the breakout signals a new leg higher.

Watch risk appetitive and commodity markets in general.

Going forward, I believe that this pair will continue to represent risk appetite as it always has, and commodity market should be paid attention to in order to get a feeling as to where the market might go next. I believe that the market has already shown what it wants to do, now the question is whether or not the rest of the markets around the world will comply with that desire. With that being said, I am bullish of this market would be very hesitant to sell it at this point in time.