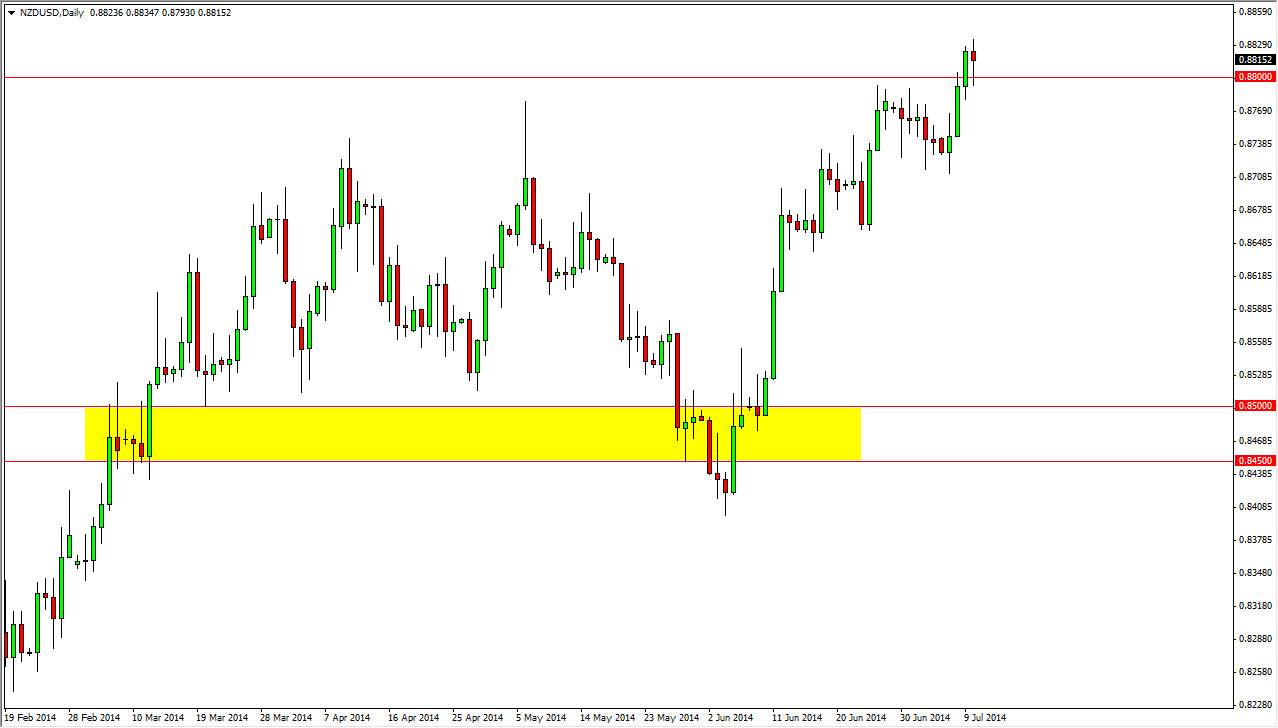

The NZD/USD pair initially tried to fall during the session on Thursday, but as you can see the 0.88 level has in fact offered enough support to turn things back into a positive spin, forming a nice-looking hammer. This hammer suggests that the buyers are going to continue to come into the marketplace and pushed the New Zealand dollar higher. The 0.88 level below should continue to offer support going forward, and I also believe that there are several different levels of support below so it’s almost impossible the short this market in general.

I think that if we break the top of the hammer for the session on Thursday, this market will ultimately go to the 0.90 level, the longer-term target that I have had for some time. It will probably be a fairly choppy move, but short-term traders should continue to step in to the market on dips as we rock back and forth. The New Zealand dollar of course has a massive amount of correlation to risk appetite and commodity prices in general. Because of this, you’ll have to pay attention to what the stock markets are going in general, and the overall attitude of commodity markets around the world.

No need to fight this trend.

I don’t see any reason to fight this trend whatsoever, so the idea of selling as and even entered my mind. With that being the case, I feel that this market is one that can only be bought, and I think that most traders around the world feel the same way. I have been watching other analysts suggest that the New Zealand dollar will be one of the favor currencies, and quite frankly I tend to agree with the overall consensus. There is a serious lack of yield in the bond markets around the world, so any situation that allows us to pick up a little bit of swap at the end of the day will in fact be attractive, especially as we enter the summer with very little in the way of volatility overall.