Although the XAU/USD pair settled lower on the first trading day of the week, the 1312/06 area continued to offer support. As a result, the pair erased some of the initial losses and created a long shadow to the down side. The market is still feeling the bearish pressure of last week’s extraordinarily robust U.S. jobs report but it appears that some investors aren’t that convinced these numbers will really alter the Fed’s plans.

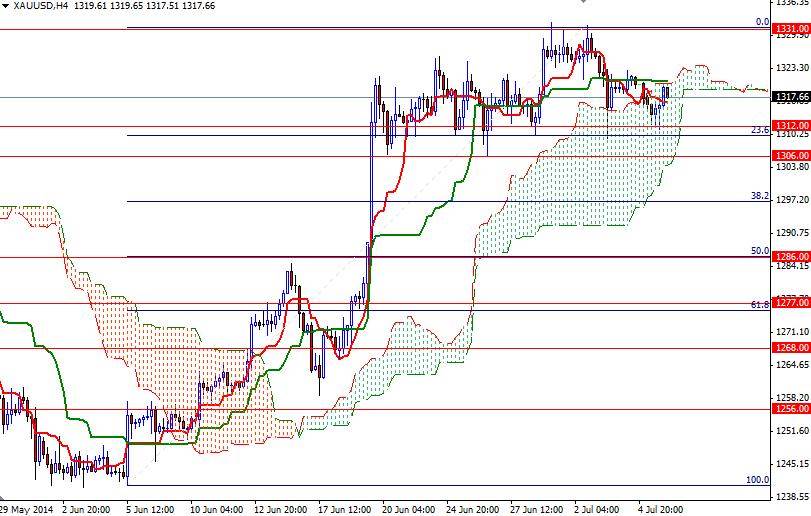

Yesterday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 146025 contracts, from 120859 a week earlier. I guess this explain why the precious metal has found some resilience over the past few weeks. From a technical point of view, trading within the boundaries of the Ichimoku cloud on the 4-hour chart suggests the pair will be range bound for some time.

I think the XAU/USD pair has to push its way through the 1324 resistance level in order to gain some traction. If the bulls manage to break and hold above that level, it is technically possible to witness a bullish reaction targeting the 1328/31 area. Only a close above 1331 would suggest that the pair may extend its gains to test the next barriers at 1334 and 1340. However, if sellers step up pressure and prices reverse, I think the first support to pay attention will be around 1312 - 1310 (23.6 Fibonacci based on the distance between 1240.50 and 1332.40). Breaking below this support could take us back to the 1306 level.