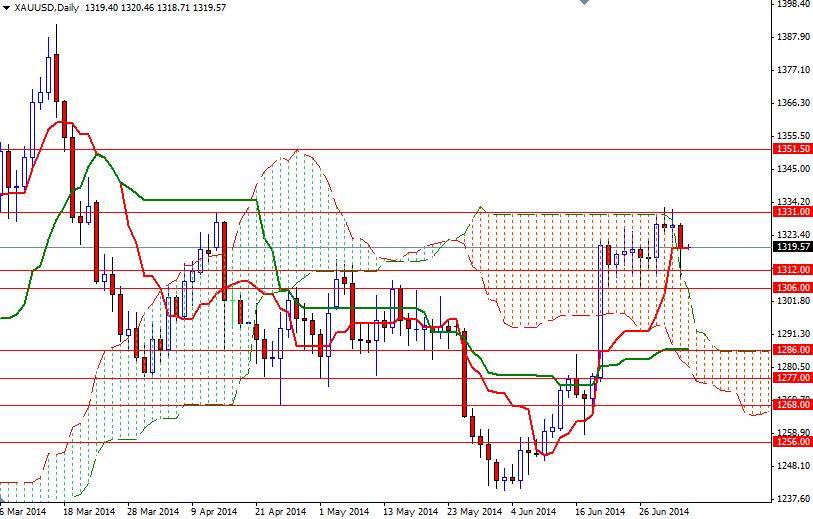

Gold prices (XAU/USD) ended yesterday’s session with a loss as strength in global equities and the American dollar helped draw investors away from the shiny metal. Although the pair touched its lowest level in five trading days after data released from the Labor Department showed that the U.S. economy added 281K jobs in June (well above expectations of 214K), prices bounced off of the 1312/06 support zone.

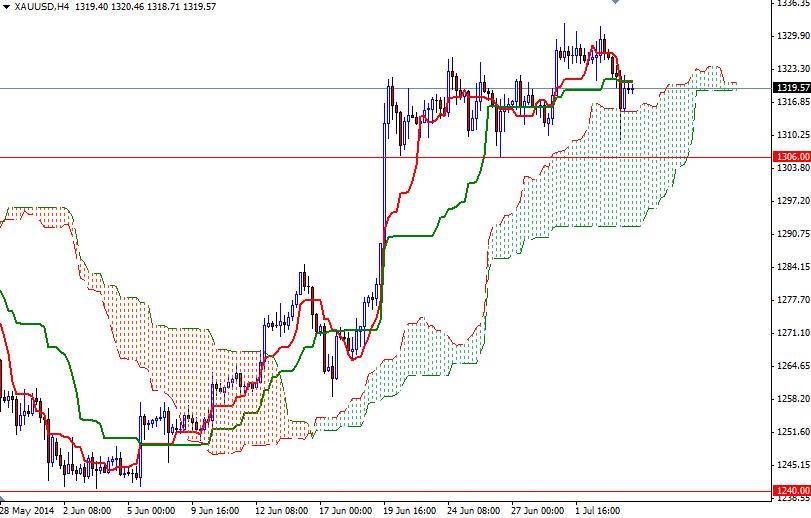

Increasing demand for the U.S. dollar tends to weaken the appeal of commodities such as gold but fears of a wider conflict in the Middle East are still limiting the down side. Today’s trading volume is expected to be thin since U.S. financial markets will be closed for the Independence Day holiday. Meanwhile, gold charts paint a mixed technical picture. Prices are inside the Ichimoku cloud on the weekly but the short term charts are slightly positive. On the 4-hour chart, the pair is trading above the Ichimoku cloud but we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross.

Speaking strictly based on the charts, I think the bears will have to drag the prices below the 1312/06 support in order to start dominating the market. This area had marked the top of the previous consolidation took place between mid-April and mid-May and not surprisingly it is acting as a strong support now. Breaching this support would make me think that the market will test 1300/1297 afterwards. Recently the XAU/USD pair has been continuously held in check by the key 1331 resistance, so shattering this barrier on a daily basis is essential for a bullish continuation. Once above that, I think the bulls will be aiming for 1334 and 1340.