Gold prices declined for the second time in three days as concerns surrounding Ukraine and Russia eased and stocks extend their gains. The XAU/USD pair traded as high as $1315.60 an ounce after the consumer price index figures came out weaker than anticipated but reversed and hit $1303.85 on the back of encouraging housing data. Data released from the Labor Department showed that the CPI increased 0.3% in June and the National Association of Realtors reported that sales of previously owned homes increased 2.6% in June.

While the numbers out of the U.S. provided further evidence that the economy is in a better shape than market players thought, I don't think they are enough to prompt the Federal Reserve to shift to a more hawkish tone on interest rates. Although this sounds supportive for the XAU/USD pair in the near term, it appears that investors want to see if the shiny metal can hold on to gains before they open larger positions. Since February, geopolitical risks only created temporary effects on the market.

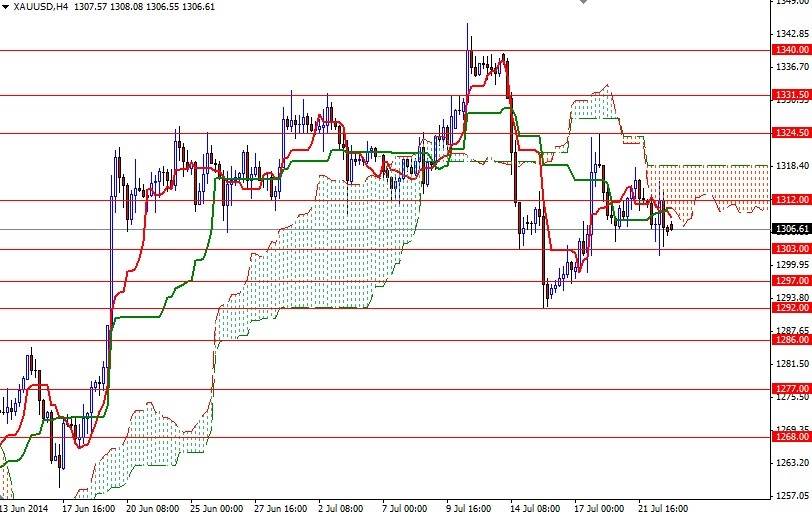

From a technical point of view, short-term and long-term charts are giving us mixed signals. The daily chart is favoring the bulls at the moment but prices are still below the Ichimoku cloud on the 4-hour time frame. In order to gain some traction, the bulls have to push and hold prices above the 1318.40 level but before that the 1212/5 resistance will be the first hurdle. If the market can climb above the clouds, then 1324.50 will be the next possible target for the bulls to capture. To the down side, the key support to watch will be 1303/1. If the bears take the reins and shatter this support, we could see the pair extending its losses and retreating towards the 1297 level. Closing below the 1297 support on a daily basis would indicate that 1292 may be tested soon after.