Gold prices ended yesterday’s session higher after minutes of the Federal Reserve’s June policy meeting failed to offer clues on the timing of rate hikes. Minutes from the June 17-18 meeting showed policy makers are planning to continue tapering and end the asset buying program before winter unless the economy deviates substantially from its expected path. The precious metal also drew strength from Federal Reserve Bank of St. Louis President James Bullard’s comments on inflation. Bullard said surprisingly fast gains in employment will fuel inflation. That could provide extra support for gold as an inflation hedge.

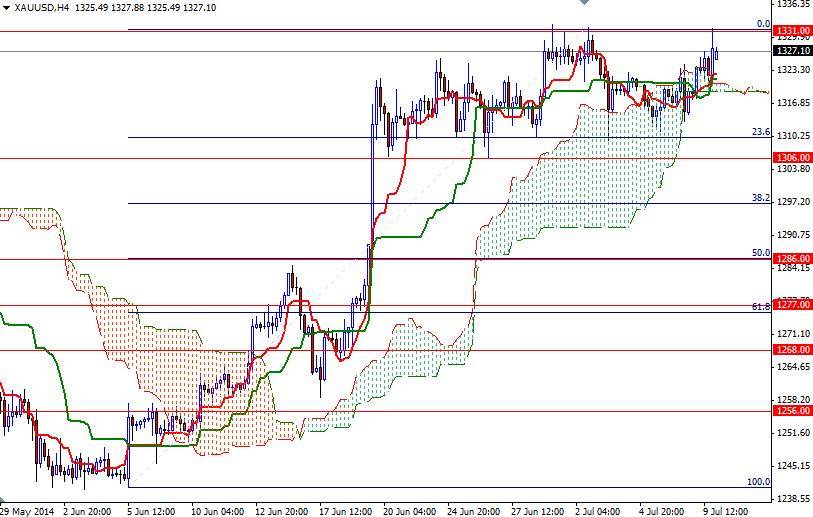

Yesterday the XAU/USD pair accelerated its advance and traded as high as $1331.65 an ounce after breaking above the interim resistance level of 1324. The pattern on the daily chart suggests that there is more volume and strength behind the bulls at the moment. Although I have been warning about the shiny metal’s resilience recently, I think the bulls will have to capture the critical resistance and push prices above the July 1 high of 1232.43 in order to challenge the bears on the next (1340/3) battlefield.

However, if the bears defend their ground and prices start to fall, expect to see some support between 1324 and 1321. A daily close below the 1317 level could encourage sellers and drag the market towards 1312.