GBP/USD Signal Update

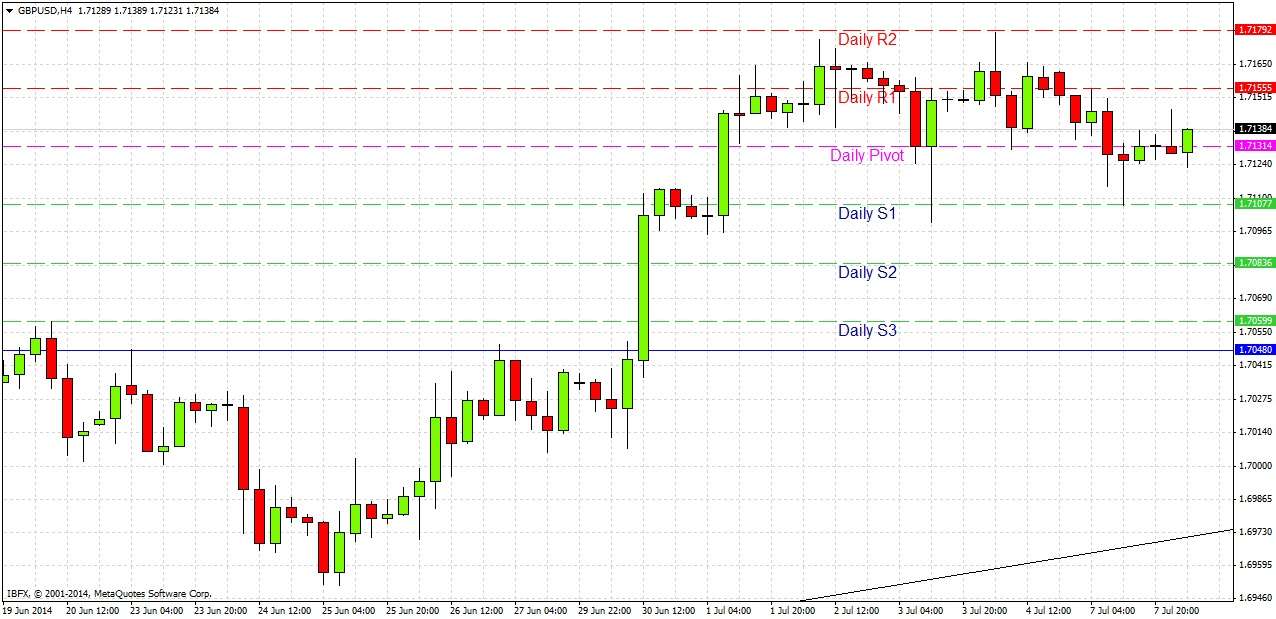

Yesterday’s signal was not triggered as the price never reached 1.7048.

Today’s GBP/USD Signals

Risk 0.75%.

Entries may only be made between 8am and 5pm London time today.

Long Trade 1

Go long following bullish price action on the H1 time frame after the first touch of 1.7048.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.7090.

Take off 75% of the position as profit at 1.7090 and leave the remainder of the position to run

GBP/USD Analysis

As expected, yesterday was a very quiet day, with a total range barely larger than the previous trading today, which was 4th July. We had a slight move down and this tells us little except that we did not make a new high yesterday, although that does not mean much yet. It is hard to really see any new information being revealed by the past 24 hours.

The upper channel trend line is no longer holding and should not be seen as having even minor significance anymore.

I do not see any short opportunities yet, and I am not prepared to look for a long until we pull back to 1.7048. Therefore we really need to wait for the price to fall about 80 pips which is quite a long way and this will quite probably not happen today. We do have some news due later but even if it is very bad for the GBP it is unlikely to cause a spike move down that far.

There are no high-impact data releases scheduled for today concerning the USD. At 9:30am London time, there will be a release of UK Manufacturing Production data. Therefore it is likely that most volatility today will occur during the earlier part of the London session.