EUR/USD Signal Update

Last Thursday’s signal expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries must be made before 5pm London time today.

Long Trade 1

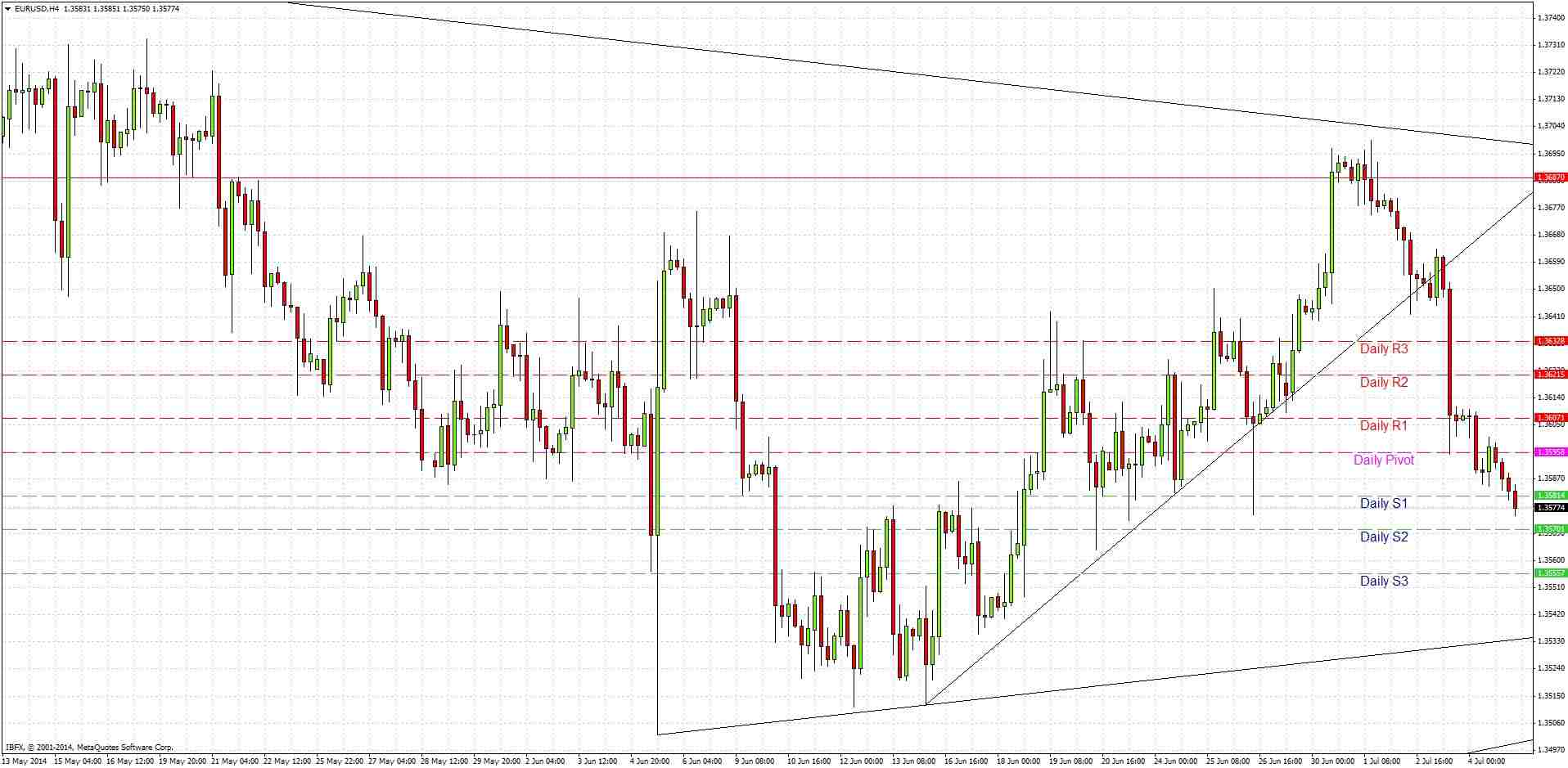

Go long following bearish price action on the H1 time frame after the first touch of the bullish trend line currently sitting at about 1.3534.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.3570.

Take off 75% of the position as profit at 1.3570 and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame after the first touch of 1.3687.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.3610.

Take off 75% of the position as profit at 1.3610 and leave the remainder of the position to run.

EUR/USD Analysis

This pair has been falling slowly and steadily from the resistance at around 1.3687 since early last Tuesday. The positive USD data that was released last Friday did nothing to stop this gentle trend. There was a little support at the round number of 1.3600 but that has now been broken. At the time of writing we are sitting on some local flipped support at around 1.3575. This is not clearly enough defined to go long here, but it may prove to be supportive enough as a zone to define today’s low.

There are no clear, well-defined levels at which to look for reversals between a short-term bullish trend line at around 1.3534, and the flipped resistance at around 1.3687.

This is not likely to be a very interesting pair to trade today.

There are no high-impact data releases scheduled for today concerning either the EUR or the USD. Therefore it is likely to be a very quiet day.