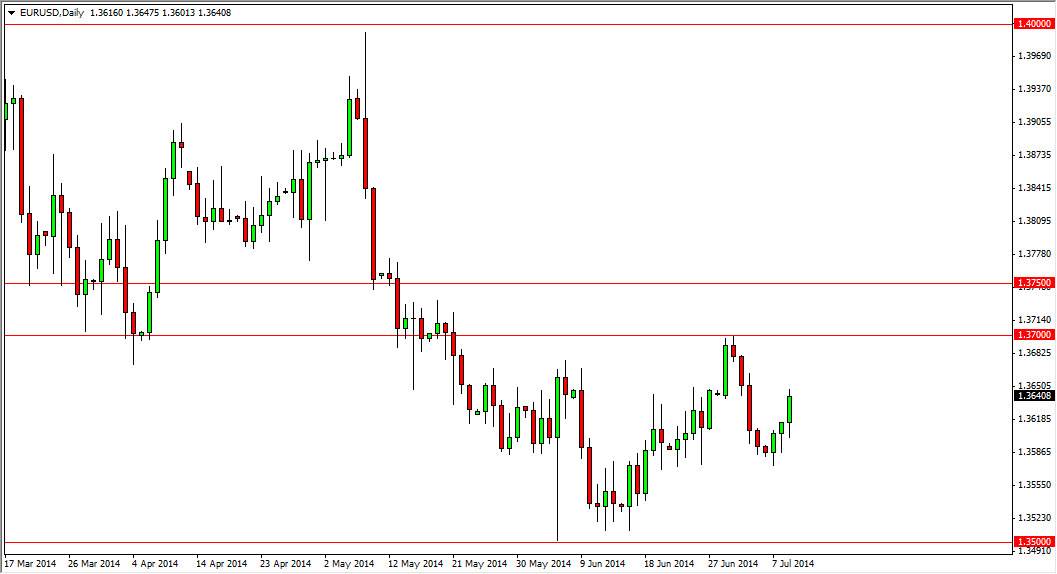

The EUR/USD pair initially fell during the session on Wednesday, but found the area below the 1.36 level to be supportive enough to push the market back off. On top of that, the Federal Reserve came out with a statement that seem to be a bit ambiguous, so the market really doesn’t know what to think. Ultimately, the market did what it typically does, sell the US dollar. That being said, we still find ourselves in a very tight market, and I don’t really anticipate this changing anytime soon.

I think that the market is essentially “stock” between the 1.36 handle and the 1.37 level. On top of that, above the 1.37 level is a significant amount resistance all the way to the 1.3750 level. Because of that, I really don’t see a reason to risk your trading capital in a market like this. It appears that this market is going to be very comfortable going nowhere over the course of the summer, and with that the market is one that I am essentially using as an indicator going forward.

The EUR/USD pair as a tertiary indicator.

The EUR/USD pair is one that I have recently been using as a bit of a tertiary indicator. This is because the pair simply isn’t tradable in my opinion, and with that I believe that the best thing I can use this market for is to guesstimate what strength of the Euro is for the day, and then perhaps look for trades in other currency pairs that involve the Euro. In other words, this pair continues to go higher, I might do something along the lines of buying the EUR/JPY pair. On the other hand, if we do start falling significantly, I might consider selling that exact same pair.

In the end though, this is the most important market to pay attention to as far as the general strength of the US dollar, so even though I don’t trade this market at the moment, I certainly keep my eye on it as he can give you an idea of not only the aforementioned Euro strength, but Dollar strength as well.