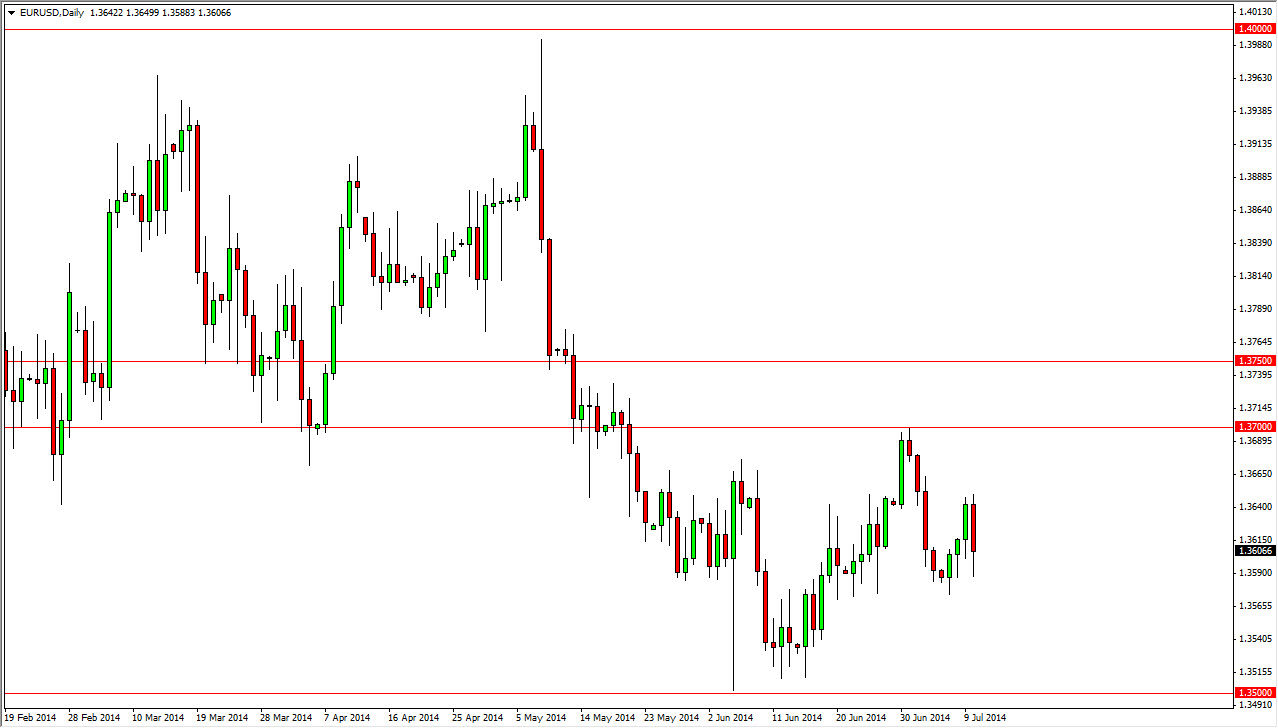

The EUR/USD pair fell during the session on Thursday, testing the 1.36 handle yet again. This is an area that is “no man’s land” as far as I see, as it is the middle of the larger consolidation region. The larger consolidation area is supported at the 1.35 handle, and resisted at the 1.37 handle that extends all the way to the 1.3750 level. With that being the case, this is a market that I have not been very interested in, but to use is a tertiary indicator from time to time.

Looking at this market, I really don’t see any reason to trade longer-term, or even more importantly: with any real size. A market like this can do serious damage to your Forex account, as there is no real trend one way or the other, and the markets struggle to be anything close to reliable.

We might be looking at the entire summer here.

I don’t see any reason why this markets ready to break out, and quite frankly I don’t see much in the next couple of months either. This might be the entirety of the summer, bouncing between the 1.35 and the 1.37 levels. However, that does lead the market to be somewhat opportunistic on short-term moves, but when we are in the middle of the entire range, I feel very hesitant to risk any money.

On the other hand, if we ended up falling down to the 1.35 handle, I would be looking for short-term supportive candles in order to place what would be a “smash and grab” type of trade for roughly 50 pips or so. On the other hand, up towards the 1.37 handle, I would also be willing to short this market for a very similar type of gain. Other than that, it’s going to be very difficult to be involved in this market, and as I had originally said about a tertiary indicator, I look at this is a way to figure out what the Euro should do against other currencies as it is most widely traded against US dollar, allowing me to transpose that attitude over towards other currencies such as the Yen, Pound, and many others.