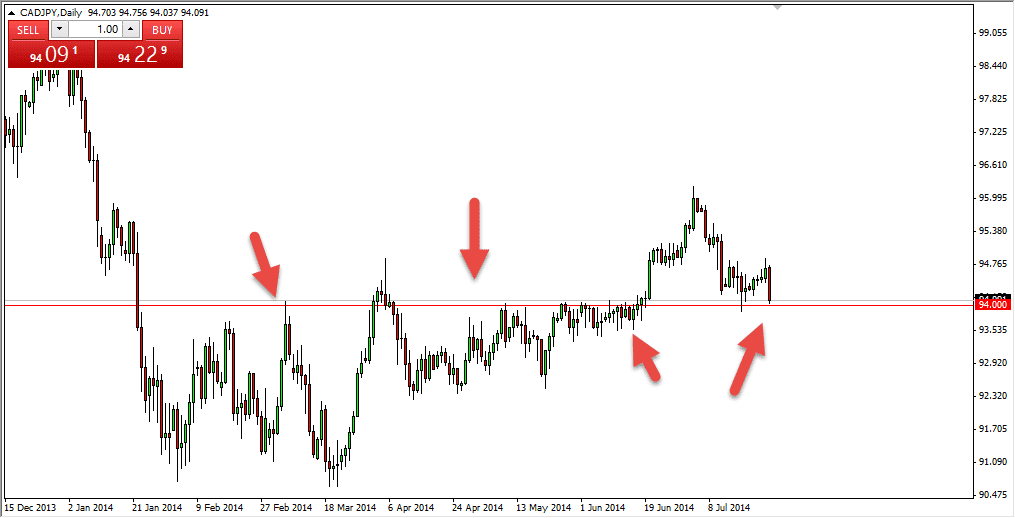

The CAD/JPY pair fell during the session on Friday, as oil markets dropped concurrently. We have now found the support at the 94 handle, an area that as you can see is plainly marked on this chart as both support and resistance previously. The Canadian dollar itself is in a bit of trouble, as the USD/CAD pair broke above the 1.08 level during the Friday session as well. Because of this, this is more or less an anti-Canada play than anything else, but this area is significantly supportive that it could cause problems for the sellers.

Going forward, I would be very interested in a supportive candle in this region, but I do not expect to see it right away. I would anticipate that there will be an attempt to completely break this paragraph and 94 handle, the real question of course being whether or not sellers can keep the momentum to the downside going. To be honest, I suspect not.

The oil markets are still in an uptrend, believe it or not.

The oil markets are still in an uptrend overall, although it has been very choppy. With that, I suspect that the market will continue to grind its way higher, with the key word being grind. With oil, the CAD/JPY pair typically moves. This is because Canada is a major exporter of oil, while Japan imports 100% of its petroleum. In other words, this is a very sensitive market when it comes to oil prices, it makes sense that the pair would look very similar to the oil markets overall.

We are also approaching an area that can be thought of as a potential uptrend line, although it would be very sloppy. With that, I believe that any breakdown at this point time will more than likely struggle. In fact, I would not be surprised at all to see a hammer over the next couple of days, one that I would be more than willing to take to the upside as this area seems to be that important. At this point in time, I am waiting to see what the daily charts bring us before placing any serious money in this market, but I recognize that we’re at very important levels.