By: Ben Myers

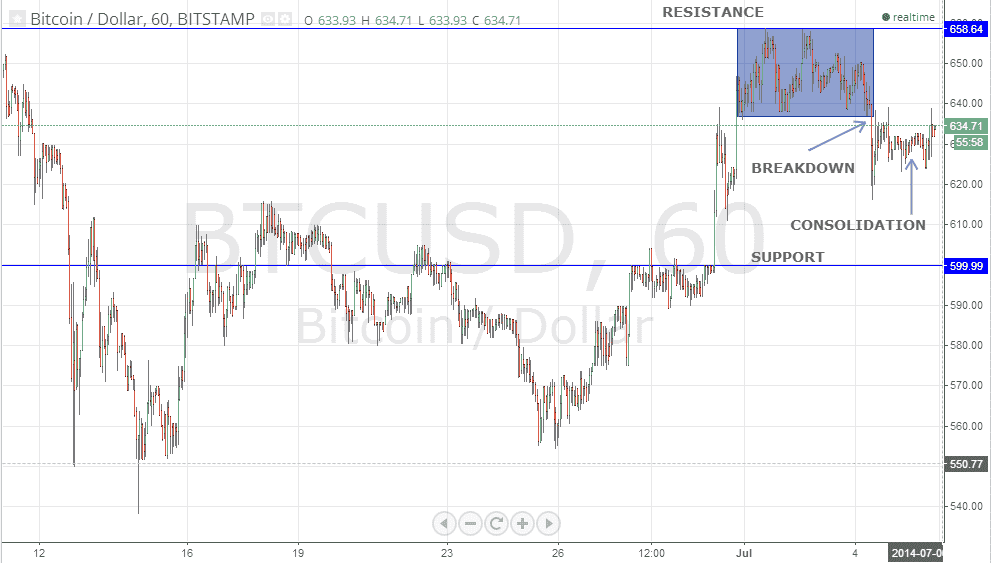

As can be seen from the BTC/USD hourly chart, the initial part of the week was marked by a let up in the upward momentum coupled with consolidation in a 20 point range of 638-658. BTC/USD provided ample trading opportunities while this trading range was maintained and 4 significant price reversals were observed. The last bounce from 638 failed and after reaching 650, the pair witnessed a huge selling pressure to break below the support in the latter part of the week to touch sub 620-level but has recovered sharply since then. Now, 660 is the near-term resistance, which needs to be breached.

Traders may adopt a “buy-on-dips” strategy on any fall towards 610-620 by placing a stop-loss at 600 for a target of 635. All long positions must be closed below 600 as the next support lies near 560-570. Long positions may also be considered after a close above 640 for a target of 655 with a stop-loss at 635.

Investors may utilize this opportunity to go long in this counter for medium to long-term. All the corrections must be bought into until 550 is breached on the downside.

The week turned out to be mostly positive concerning the news related to the digital currencies. Bank of Russia has suggested in its recent statements that the central bank is softening its stance on digital currencies and is gathering information about them. Expedia’s executive vice president of global product Michael Gulmann has reported that the firm has exceeded its estimate of Bitcoin sales and that its decision to enter into digital currencies is a remarkable success. In a move aimed at encouraging the use of digital currencies, especially Bitcoin, Overstock has decided to shower the Bitcoin-friendly vendors with incentives. Hence, vendors using the Overstock platform can take advantage of the discounts and favorable terms, if they start accepting Bitcoins in payment. The European Banking Authority (EBA) has in its latest opinion, warned the financial institutions to stay away from the digital currencies until a new set of regulations is in place.