By: Ben Myers

Bears clearly have the upper hand in this battle and it would be safe to say that the bulls will take some time to recover. Bitcoin, which was trading at around 580-585 yesterday, has now slumped approximately 5% to 555-560 levels. This is a big, single-day loss in recent times due to the absence of any major positive triggers. The RSI indicator at 30 is showing no signs of an immediate reversal as of yet. Bitcoin is currently trading at $562.43.

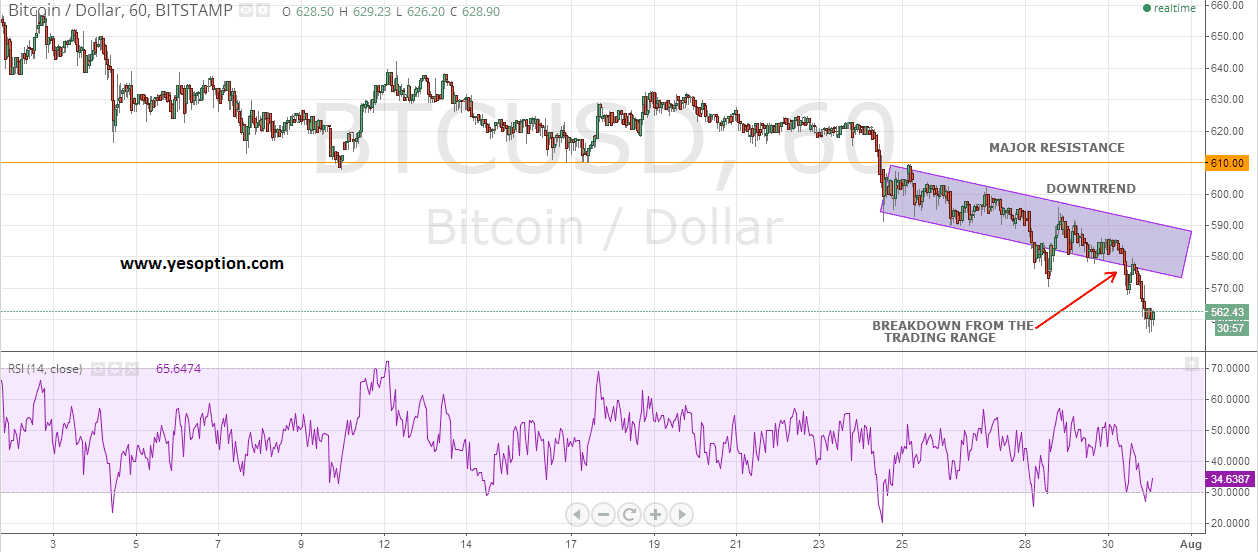

As can be seen from the hourly chart, BTC/USD has broken down from the narrow range and is trading very close to the strong fundamental and technical support zone of 540-550. It must be noted that the BTC/USD has already tested 555.90 and any move to retest this low should be seen as a buying opportunity. The digital currency can be bought now and on successive declines till 540 is held for a target of 580. The currency looks reasonably priced from a medium-term to long-term perspective.

As of now, the pair is oversold and a relief rally may come in at any time. Therefore, building short positions in the counter is not advised. Traders must wait for a rise till 575 to go short for a target of 560 with a strict stop-loss placed above 580.

Overstock has announced its plans to expand its Bitcoin payments program to international customers. With this expansion, the company is breaking the norm of “US-only Bitcoin payments” and plans to reach out to other global networks in the next four to six weeks. Leading Bitcoin processor, BitPay, has announced a new pricing plan that allows merchants an unlimited use of any plugin, API or app and makes it basic level of service free. CoinSafe has come out with an app that can virtually turn any business into a virtual ATM. These free apps allow businesses to trade Bitcoins directly with the customer.