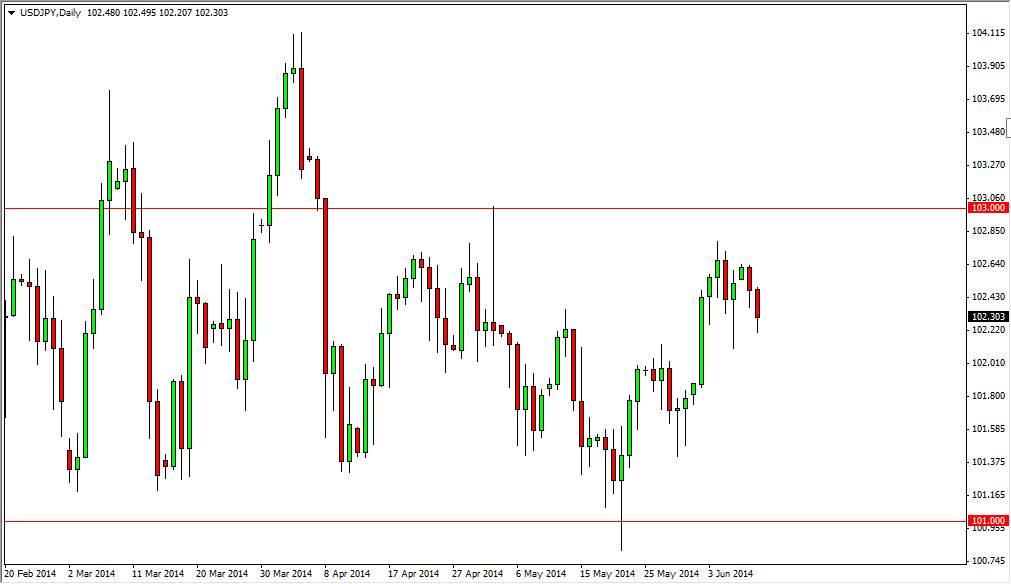

The USD/JPY pair fell during the bulk of the session on Tuesday, but continues to find the 102 level to be supportive enough to keep the market somewhat afloat. I personally believe that the market is still heading to the 103 level, but it might be a bit difficult to get up there in the meantime. After all, the area is significant resistance, so I have to believe that there are a lot of sell orders between here and there.

Nonetheless, I am bullish of this market overall and I believe that ultimately we will break above that 103 level. Breaking above the 103 level would send this market to the 104 level, and then possibly the 105 level ultimately. I think that’s my longer-term target, so therefore I am very bullish as market. However, I recognize that there will be several setbacks along the way.

Buy only market.

I have no interest in selling this market at all, as there are more than enough support areas below to keep this market afloat. I believe that buyers will step into this market again and again, and then eventually the interest rate differential will become too much for the Japanese yen. The Bank of Japan wants to keep the value of the Yen down, and 102 is simply far too expensive. The market will continue to be choppy in the meantime, and as a result it will more than likely be a short-term traders cut of market, because most traders will not be a hang onto massive volatility that we will see over the next several weeks if not months.

Ultimately, I believe that we are starting to form a longer-term basing pattern, and because of this I feel that you cannot sell this market under any circumstances, at least until we get well below the 100 level, something that I do not plan on seeing anytime soon. On top of that, it’s very likely that the Bank of Japan will get involved if we do fall that low, so I think that this is essentially formed a bit of a bottom longer-term.