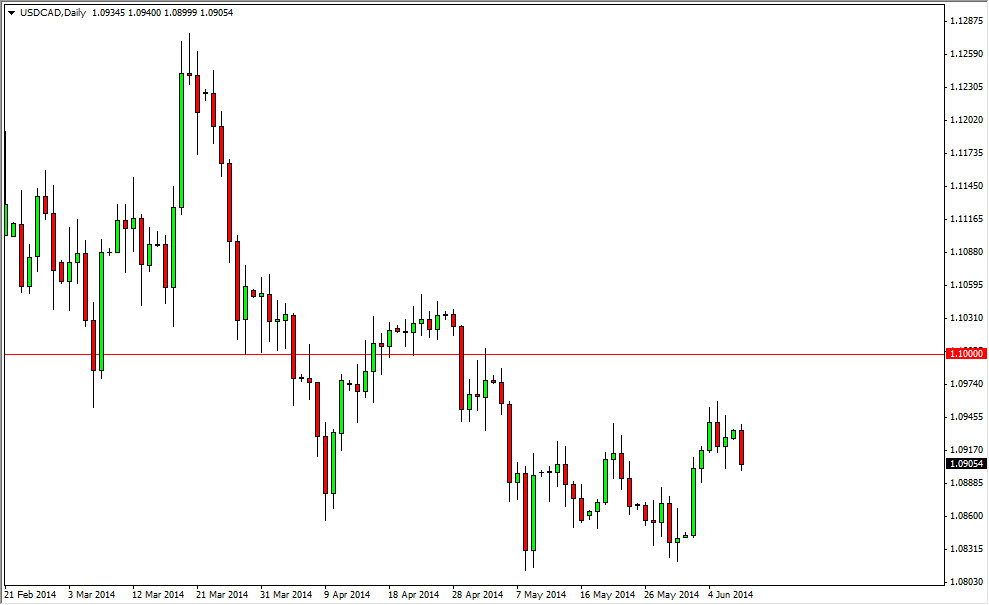

The USD/CAD pair fell during the course of the session on Monday, pulling back to the 1.09 level. This area was the site of a recent breakout, and as a result I believe that we will more than likely see support in this general vicinity. It’s a simple “breakout and retest of previous levels” type of situation that we see time and time again in technical analysis. I believe that the market will go higher to the 1.10 level given enough time, but it will more than likely be a very choppy affair between here and there.

I don’t necessarily believe that the 1.10 level will be that difficult to overcome, but it will take a little bit of work. If we get to that area, it’s likely that the market will pull back, but I believe that we could use that pullback as a momentum building exercise, and use that as an opportunity to breakout above the aforementioned 1.10 level. I think that the resistance at that level goes all the way to the 1.1050 level though, so it’s more of a zone than anything else.

Oil markets and their influence on this market.

Oil markets will often dictate what happens in the Canadian dollar, so I believe that you will have to pay attention to that market when trading this one. However, the oil markets have been diverging a bit from the usual correlation between a higher Canadian dollar and higher oil price, so be aware the fact that they don’t necessarily have to follow each other. Nonetheless, a higher oil price can sometimes give you a little bit of a “heads up” as to what’s going to happen over year.

I believe that the 1.08 level is a bit of a “floor” in this market though, and that it will be difficult to break down below that area. If we did, I think the next stop would be the 1.06 handle, and possibly even lower. Ultimately though, I suspect that we will see the 1.1250 level tested, but it’s going to be a very difficult road to that area.