The XAU/USD pair had an interesting session with the bulls and bears gaining and losing ground almost equally. Yesterday, data from the world’s largest economy were mixed. Consumer price index came in stronger than expected with a print of 0.4% but data on housing market was disappointing. The Commerce Department’s report showed that building permits decreased 6.4% to a seasonally adjusted annual rate of 991K in May

The initial market reaction to inflation numbers was positive for the greenback and triggered a sell-off, causing gold prices to hit the $1257 level. However, the XAU/USD pair rebounded sharply and pared nearly the entire decline. The fact that we have seen a hammer followed by a shooting star suggests that we are going to be range bound. The XAU/USD pair has been trading in a relatively tight range during today’s Asian session as investors are waiting for the outcome of the Federal Open Market Committee meeting. The U.S. Federal Reserve reduced the monthly pace of asset purchases by $10 billion in each of the past four meetings. I don’t expect any deviation from previously announced policy plans but the central bank could use this meeting to map out its plan for rate rises.

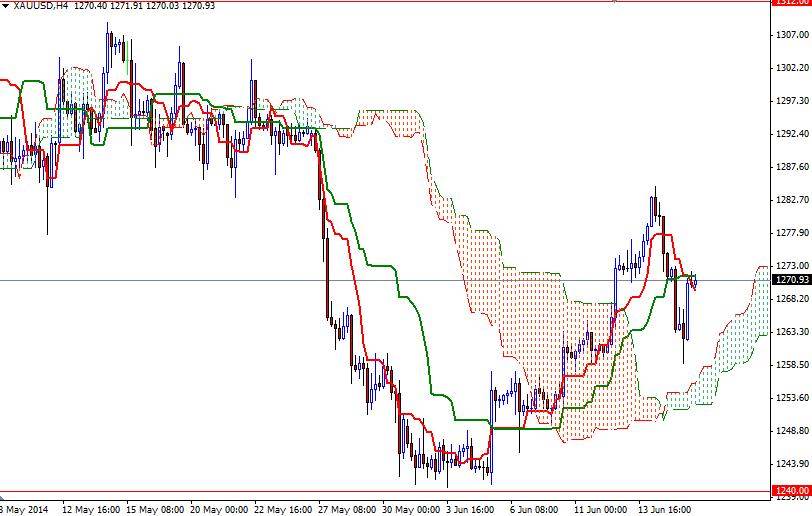

Currently the XAU/USD pair is trading above the Ichimoku clouds on the 4-hour time frame but prices are still below the clouds on both the weekly and daily charts (i.e. technically there is more resistance to the upside at the moment). I think the bulls have to break through the descending trend-line which the market has been respecting for the last couple of months and push prices above 1286/8 in order to test a key resistance in the 1297 - 1300 zone. To the down side, support can be found at 1268 and 1262. It is quite possible that the pair will continue its bearish tendencies if the 1256 support gives way.