The XAU/USD pair had an interesting week, as prices finally broke below the 1277 - 1268 support area which had been a bottom for the market since the beginning of April. Not surprisingly, gold prices continued to slide after this floor disappeared and traded as low as $1242.11 an ounce, a level not seen since February 3. Lately, easing concerns surrounding Ukraine and Russia coupled with the perception that the major stock markets will continue to rally have been depressing the attractiveness of safe-haven gold.

Recent data out of the U.S. fueled optimism the second quarter will be better than the first quarter. The market is focused on the fact that key indicators have begun to improve from weather-affected levels earlier in the year, and that is contributing to dollar's strength. As usual in the first week of the month market participants will have plenty of economic data to digest, but of course the U.S. Labor Department's employment report and ECB policy announcement will draw more attention as usual.

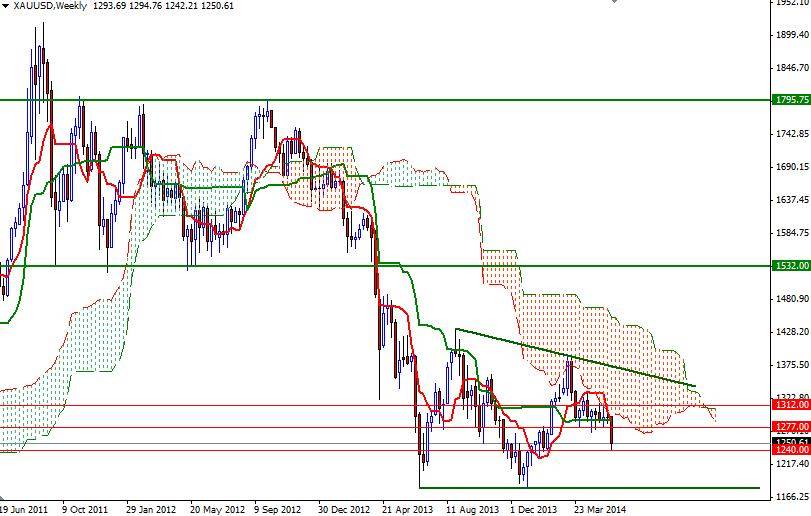

On the weekly, daily and 4-hour time frames, the XAU/USD pair is trading below the Ichimoku clouds and that means the outlook for gold is gloomy. As we can see, rebounds are getting weaker and there is a possible descending triangle forming. Last week's price action marked a departure from the consolidation area between 1312 and 1268, and because of that I think the market will be heading for the 1213 level sooner or later. Although technical formation on charts suggests there is still some room for the pair to sink this month, I can’t rule out a pull back towards the 1277 - 1268 area because the market sometimes returns to a level it has struggled to break out of before resuming the trend. To put shortly, I think this month's trading range will be between 1277 and 1213. Pullbacks could provide nice opportunities in this market as long as stocks on major world markets don't crumble.