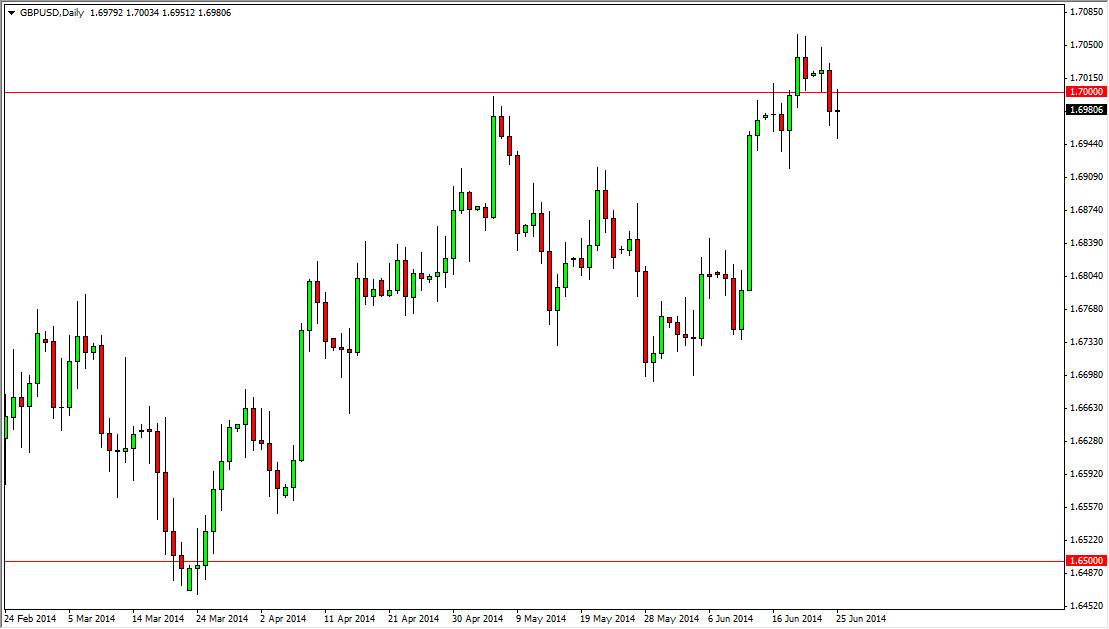

The GBP/USD pair went back and forth during the course of the session on Wednesday, testing the 1.70 level as resistance, and as a result it appears that the market failing there shows that the resistance is in fact still viable. However, the market pulled back to the 1.6950 level, finding plenty of support down there as well. Because of this, it appears the market will probably slam around in the short-term, but I recognize that the trend is most certainly to the upside, and that of course isn’t going to change anytime soon.

This market has been bullish for some time, and I don’t see any reason why that’s going to change. Eventually, I believe that the market breaks above the 1.70 level, and then more importantly above the 1.7050 handle which of course is the top of the resistance. Once we get above the 1.7050 level, this market should take out to the upside. In fact, at that point in time I would expect the market to go as high as the 1.75 handle.

Poor US GDP numbers should help propel this market higher.

With the GDP numbers coming out of the United States much weaker at the revision, I suspect that the US dollar may get a little bit of a beat down. On top of that, it could signal that the Federal Reserve can’t taper off of quantitative easing quite as quickly as once thought. With that, the British pound should continue to gain overall against the US dollar, as it is somewhat of a safety currency, but at the same time one that offers a little bit better yield.

I think that the 1.75 level will be targeted by the end of the summer, although it will more than likely be a bit choppy here and there. Pullbacks should continue to be supportive, and I believe that the 1.69 level is a little bit of a “floor” in the cable pair at the moment. As far selling is concerned, I don’t have any interest in doing so until we get below the 1.67 handle, which is very unlikely.