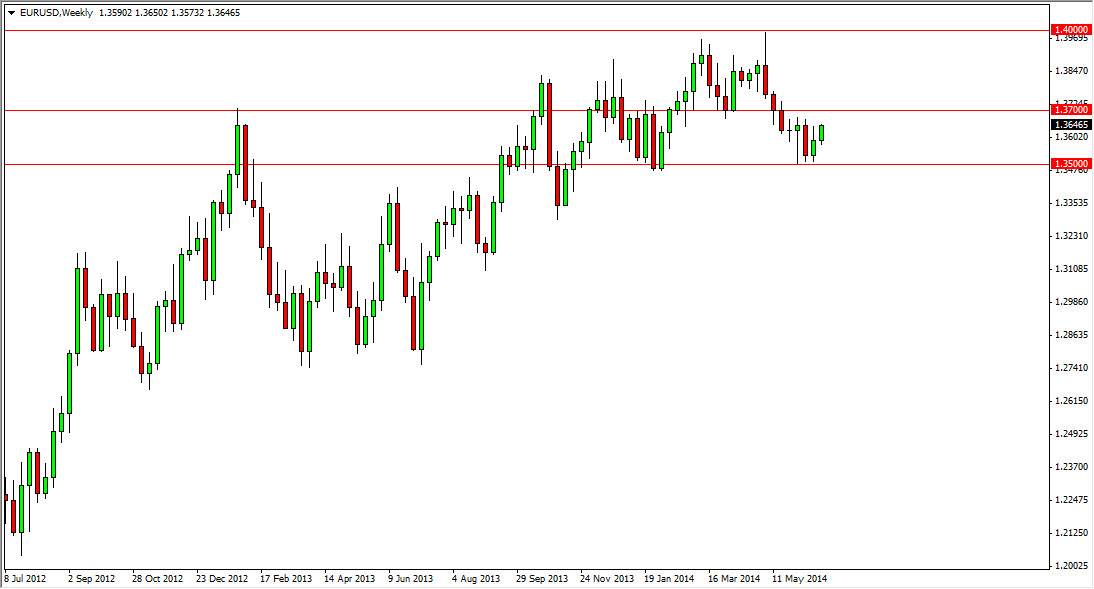

The EUR/USD pair had a bit of a bounce towards the end of June in order to test the 1.3650 area. However, I think that the real significant resistance is closer to the 1.37 handle, and as a result it really doesn’t impress me quite yet. Yes, the market is in a bit of an uptrend overall, but quite frankly this is a pair that has been very difficult to be bothered with as the market simply isn’t making much in the way of moves.

That being said, there are a couple of areas that I am watching in order to make a significant trade. In my opinion, the 1.37 level should be the gateway to go much higher. However, when I say gateway, and when I say much higher, I don’t think it gets above the 1.40 level. I know that doesn’t seem like much, but the way that this market has been acting lately, it’s about as good as things are in it yet. On top of that, we are heading towards the middle the summer soon, and as a result there is the likelihood that the market will do very little.

There is of course a downside scenario as well.

The downside scenario that exist in this market is a break down below the 1.35 handle. If we get that move, we will more than likely head to the 1.33 handle first, and then possibly 1.31 after that. However, the real question is whether or not he can actually happen. That being the case, I am a bit hesitant to get overly involved in this pair, and would highly recommend paying more attention to the EUR/CAD pair, one that I have also done a monthly forecast for July here at DailyForex.com.

Going forward, I think that it will be a lot of noise that we see in this market. I’m not necessarily holding my breath for significant volatility, simply because we do not have any precedent for it recently. Ultimately, I believe that this market will probably put everyone to sleep, just as it has been going for some time.