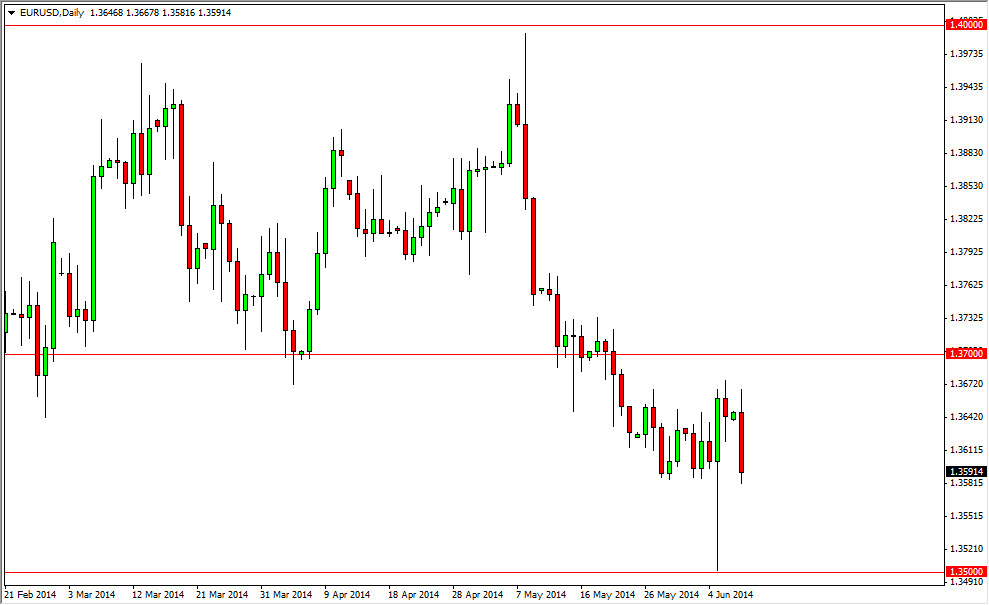

The EUR/USD pair tried to rally initially during the day on Monday, but as you can see fell significantly after failing. With this, the market tested the 1.3600 support region, which is the top of the wick from the hammer last week, which saw the market fall the way down to the 1.35 level. That area should be the bottom of the market as far as I can tell, so if we do fall towards that direction, I am very interested in buying supportive candles all the way down to that level, and on all time frames.

It appears to me that the market will more than likely bounce around between the 1.35 and the 1.37 levels in the near-term, and as a result I believe that playing this market in terms of range bound trading will be the way to go for the next several weeks, if not months.

Summertime slows down, but can be very profitable.

The summertime of course slows down in general, but it could be a very profitable time to trade the markets. After all, when you have a nice range bound market that is clearly defined, it’s nice to be able to take short-term trades time and time again until they simply don’t work. Quite often what happens is that you will make several winning trades in a row for some time, and then eventually breakout of the range. The last time I traded like this during the summer time I had 6 or 7 winning trades and finally had a loss. In the end, that’s all you have to do in order to make a lot of money in this market.

I believe that there is enough confusion between the European Central Bank and the Federal Reserve that the market will find it very difficult to pick up any real traction in one direction or the other. Because of this, I plan on taking advantage of the very obvious support and resistance areas, and plan to trade as nimbly as possible in this choppy market.