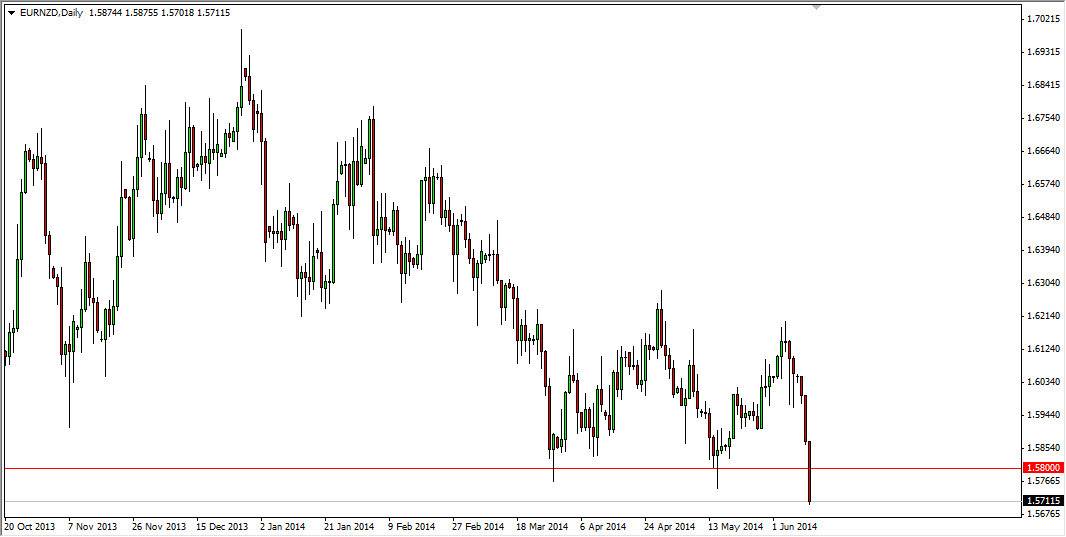

The EUR/NZD pair fell rather hard during the session on Wednesday, breaking below the 2 lows that we had seen recently near 1.5750 or so. Because of this, we have broken the backs of 2 significant hammers, and I believe that this market is about to start falling significantly. With that in mind, I think that the market can probably drop to roughly 1.54 or so, with the 1.55 level being a stop based solely upon the fact that it is a large, round, psychologically significant number.

A pullback to the 1.58 level will more than likely find sellers, as it was once supportive and now should be resistive. It’s a basic tenet of technical analysis, and a resistive candle in that area would have me very interested in not only shorting this pair, but being aggressive about it as well. This market has a decent spread, and features 2 of my favorite currencies to trade. Because of that, I love trading this particular pair, even though a lot of you probably don’t even pay attention to it.

Commodity prices might be able to help as well.

If we get a pop in the commodity markets that could put a little bit of a fire underneath the New Zealand dollar thereby pushing this market much lower. The Euro has its own well-documented problems, so obviously watch the EUR/USD pair, as a break below the 1.35 level should send the Euro and a bit of a freefall against most other currencies, this pair concluded. After all, this is simply a proxy for the EUR/USD and the NZD/USD major pairs.

I believe that this is the type of market that you can sell the rallies as they show resistive candles, and that it should continue to do quite well to the downside going forward. On a move above the 1.5850 level however, I would have to switch my opinion and start buying this market as that would show a significant bounce was probably in the works.